The Stock Scanner Guide (and why we built MOMO Pro the way we did)

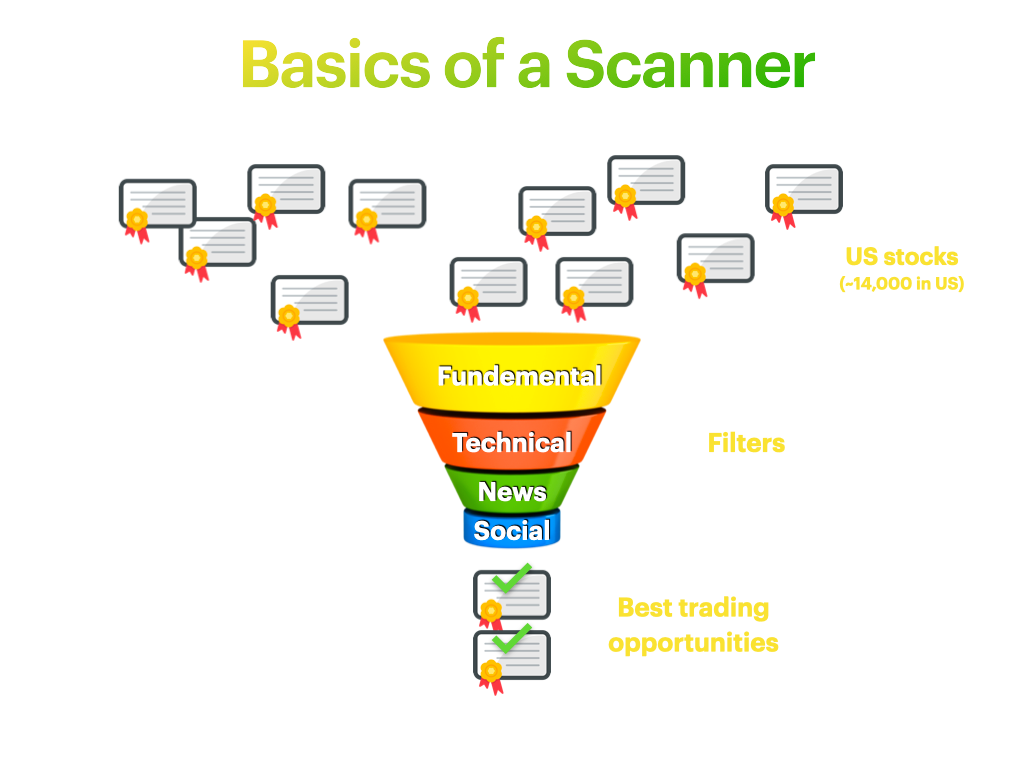

The U.S. stock market has over 7,000 listed stocks moving simultaneously throughout the trading day. There are also another 1800 ETFs and thousands of warrants and other symbols. This doesn't even include the OTC market.

To find and filter trading opportunities, most traders utilize the power of stock scanners to optimize their efforts for the simple reason you cannot watch every stock at all times.

A stock scanner lets you do this much more efficiently and tuned to your unique style and needs. Keep reading...

Why Day Traders Need A Stock Scanner?

Markets are filled with noise. Being able to filter through this noise to identify tradeable plays is critical to beating your competition as a day trader. Scanners are used to enhance a trader’s agility enabling them to maximize their focus on stocks that are seeing the action such that they don't miss out and can simulatenously manage their current positions.

And much like a salesperson, traders need to have a constant pipeline of opportunities to maximize their daily profits (and cut their losses). The best opportunities will shift between stocks by the day, by the hour or less and a scanner helps you zone in on the action - and importantly be more attuned and ahead of the masses.

What is a Stock Scanner?

A stock scanner, also referred to as a stock screener (more or less, we discuss the differences in other posts) , is a service that filters the markets to find stocks that meet a specific criteria. The criteria can be preset or customized by the trader. Scanners scour through streaming data in realtime to highlight trades based on your settings. However, as we have pointed out before this can dangerous as traders can feel like they can't lose with this newfound power and trader's become impulsive and forget their trading rules and then the market.

It’s important to understand that a scanner is a tool that can be very useful in the right hands to enhance your agility to monetize opportunities and recognize underlying market trends and momentum.

Types of Scanners

Scanners search the market to find stocks that match specified criteria. There are several types of scanners; HOD/LOD, Technical, Fundamental, and News to name the bulk of them.

HOD/LOD Scanners

HOD/LOD scanners are built to parse new highs of day and lows of day in realtime to catch breakouts or breakdowns as fast as possible. These may have the ability to filter by price, sector, volume or other methods to allow trader to hone in on specific needs. HOD/LOD scanners can also provide valuable insight in tracking stocks which may provide sympathic moves as well as provide rapid insight into "risk off" sentiment when symbols like GLD, TLT, SQQQ, TZA and the like get bid.

These scanners are also useful for tracking exhaustion of a sell-off for the "buy the dip" plays and worth noting while used heavily by day traders; swing and momentum traders use to improve entries.

Technical Scanners

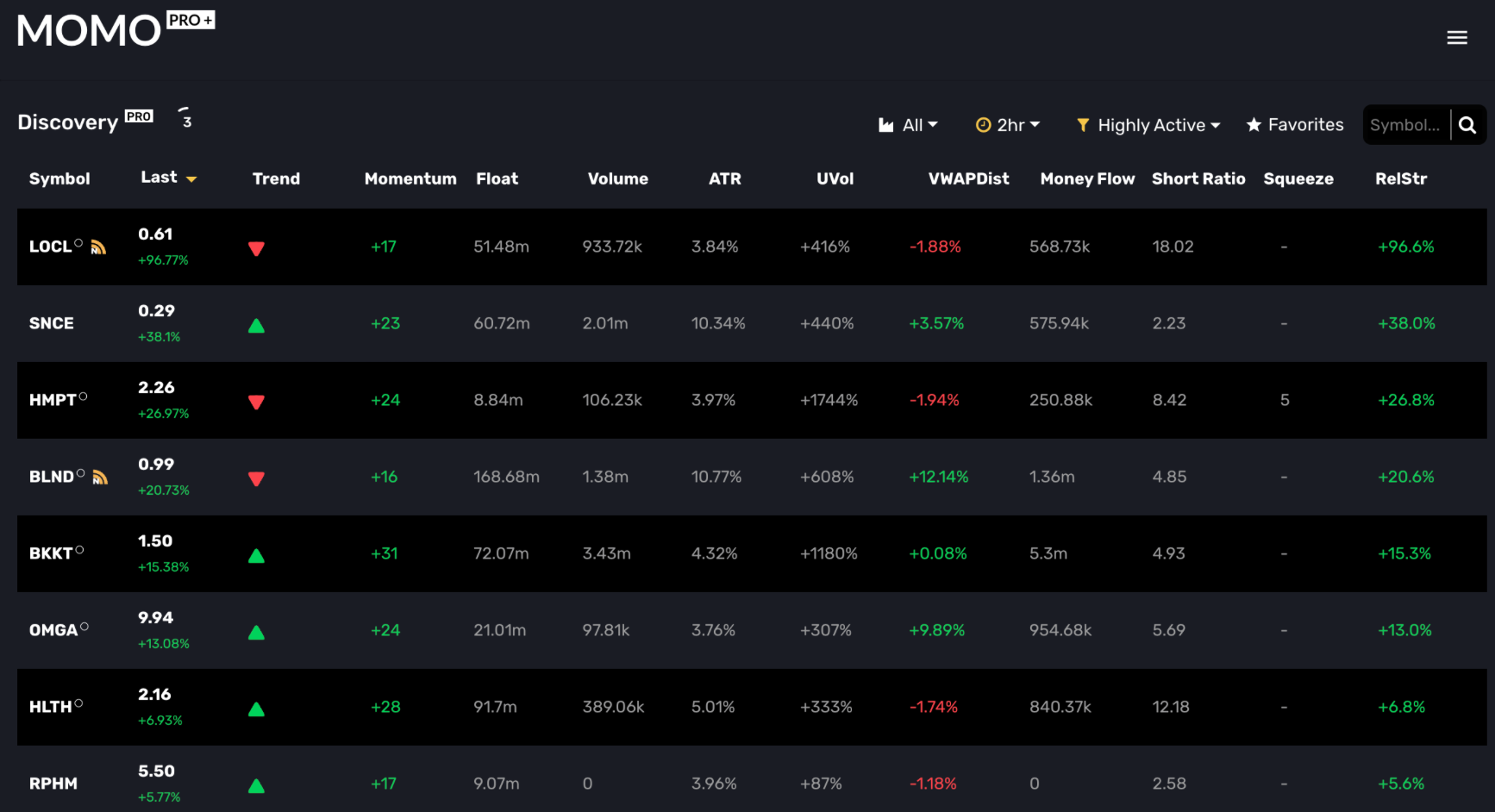

Technical Scanners are the most commonly used and traders tend to use the pre-built scans. These can be real-time scanners which search for intraday trading opportunities or delayed scanners which search for potential swing trade opportunities using end of day data. Many technical scanners offer multiple timeframes and various focus for honing in opportunities. At Mometic, we call these screeners and ours is named, "Discovery".

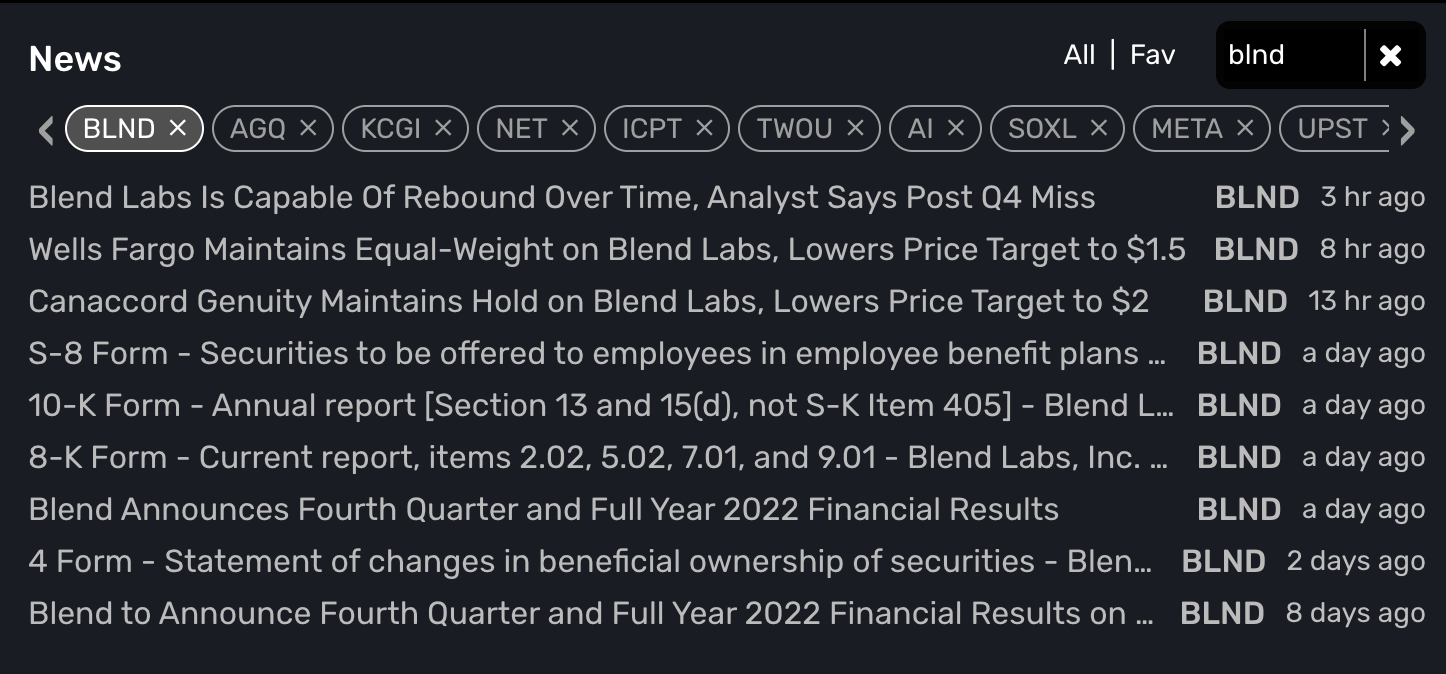

News Scanners

Just as you may expect - news Scanners scour the news and media to surface the latest press releases, analyst upgrades, or earnings reports based on the stocks of interest or meeting your criteria. The goal is similar and can be used in conjunction with other scanners to assess a stocks move as you will often see a news report and price jump (or dump).

These scanners monitor various newsfeeds to pull information on specific companies or keywords that the user provides. The goal is to get a first-mover advantage to find key news items that can move a stock. SEC filings, upgrades/downgrades/coverage and press releases are all shown. Users can also use these scanners to also explain what may be driving a powerful price move in the underlying stocks. News scanners are most effective with real-time scanning.

Fundemental Scanners (Screeners)

Fundementals are typically used for value or long-term investing. Cashflows, earnings, dividends, ratios are all provided in Fundemental Scanners. These are usually based on end of day data, but may have live last pricing. These tools are fairly static and you won't be using them to time entries and get best price, but to position for a long term investment. That said, certainly useful to understand what type of business you are getting into for day trades. Wrongly placed conviction without merit can turn the tide quickly on day trades (Meme stocks as an example).

Where Can You Find Scanner Tools?

There are various forms of scanners available at different price points. Keep in mind price is a powerful element in of itself. Regardless of the capabilities you need to be able to trade above your cost basis of your tools. Spending $100's a month to make a few thousand may not make the most sense as this cuts into your profits.

There are some free ad-based tools and there are tools that are cost thousands a year. Here is a bit more detail:

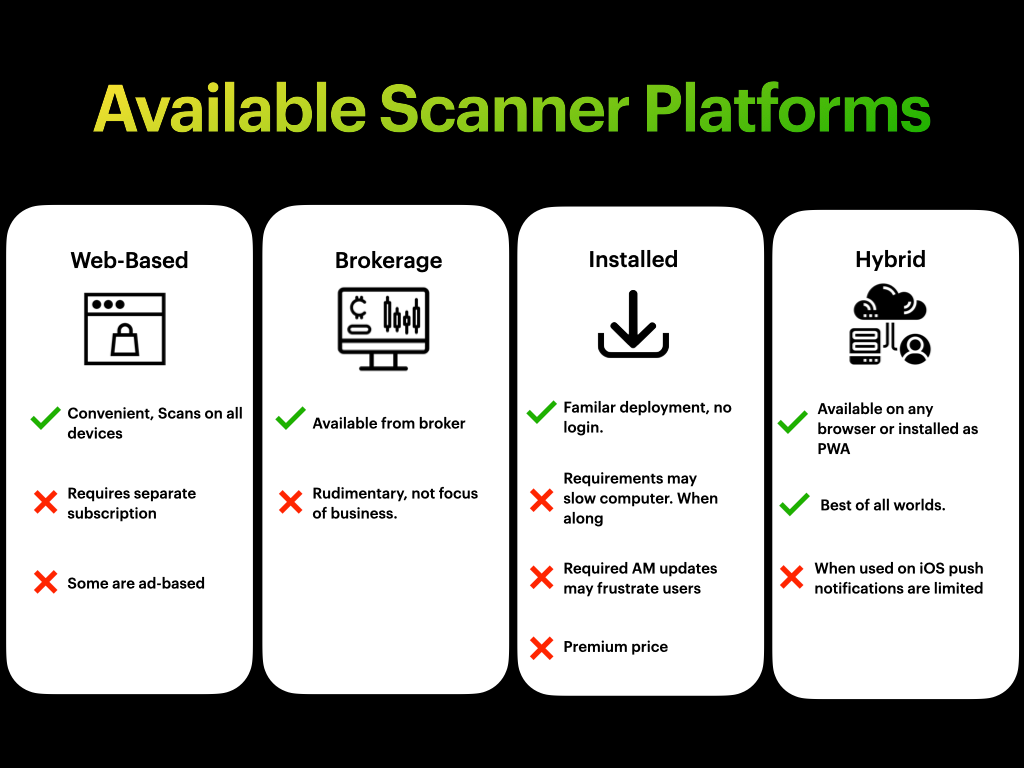

Web-based - scanners tend to be subscription-based with the data management and analytical processing performed in the cloud and streaming the results to your device. These are very convenient when you need to access scans away from your desktop.

Trading platform - scanners are a feature embedded within your trading platform. These are provided by your broker and can range from simple to sophisticated with prebuilt scans and customizable scans. Some of these are programmable but also offer limited to no support and are rarely kept up to date.

Downloadable/Installed - scanning software is a traditional way to access your scans as you can input and program criteria as well as control the dataset. The downside is that scanning is a quite a resource hog when used along with your trading and brokerage tools. Therefore, some traders will only run the scans manually or limit the sample size of the scans to specific lists of types of stocks.

Hybrid - There are pros/cons to each. We like our approach and wouldn't change a thing. MOMO Pro works on all devices and also despite being constantly updated is transparent to the user - meaning ill-timed downloads and updates. We are built using web sockets and real-time connections which are the same as a downloadable application would use. Further we are now not just a "web page", but a "web platform" complete with detachable windows and also what's known as a PWA - which lets you actually install MOMO onto your device using very modern web PWA technology.

How to Build a Profitable Scan Strategy

For day traders that wish to customize their scanners, here are some tips on how to build a great scan.

STEP 1: Define your desired trading opportunities

Before you define your scanner settings, you need to know what types of trade opportunities you want.

- Are you looking for breakouts to play the long side or breakdowns to play the short side?

- Are you looking for pullback entries on uptrends or downtrends?

- Are you looking to play only stocks trading above $50.00 per share?

- Are you looking for stocks trading at 200% unusual volume when a breakout occurs?

- Are you typically a swing trader or scalper?

- Do you want the stock to have some combination of the above?

These questions will help you define the criteria for your scan. You need to know what you’re looking for in order to specify the criteria for instructing the scanner to find specific opportunities. This also requires having a trading methodology or system so that you know exactly which set-ups you prefer to play.

STEP 2: Define your best trades

Now in actuality this should be Step 1, but in reading this order you will see the logic in fact that you need to review your trading history and what has worked for you and what has not. Catalog these into 2 or 3 trades that have proven to work for you consitently. After this, identify the parameters which match with these trades. Perhaps you are better with smaller priced stocks and scalping the momentum, timing short squeezes or something similar.

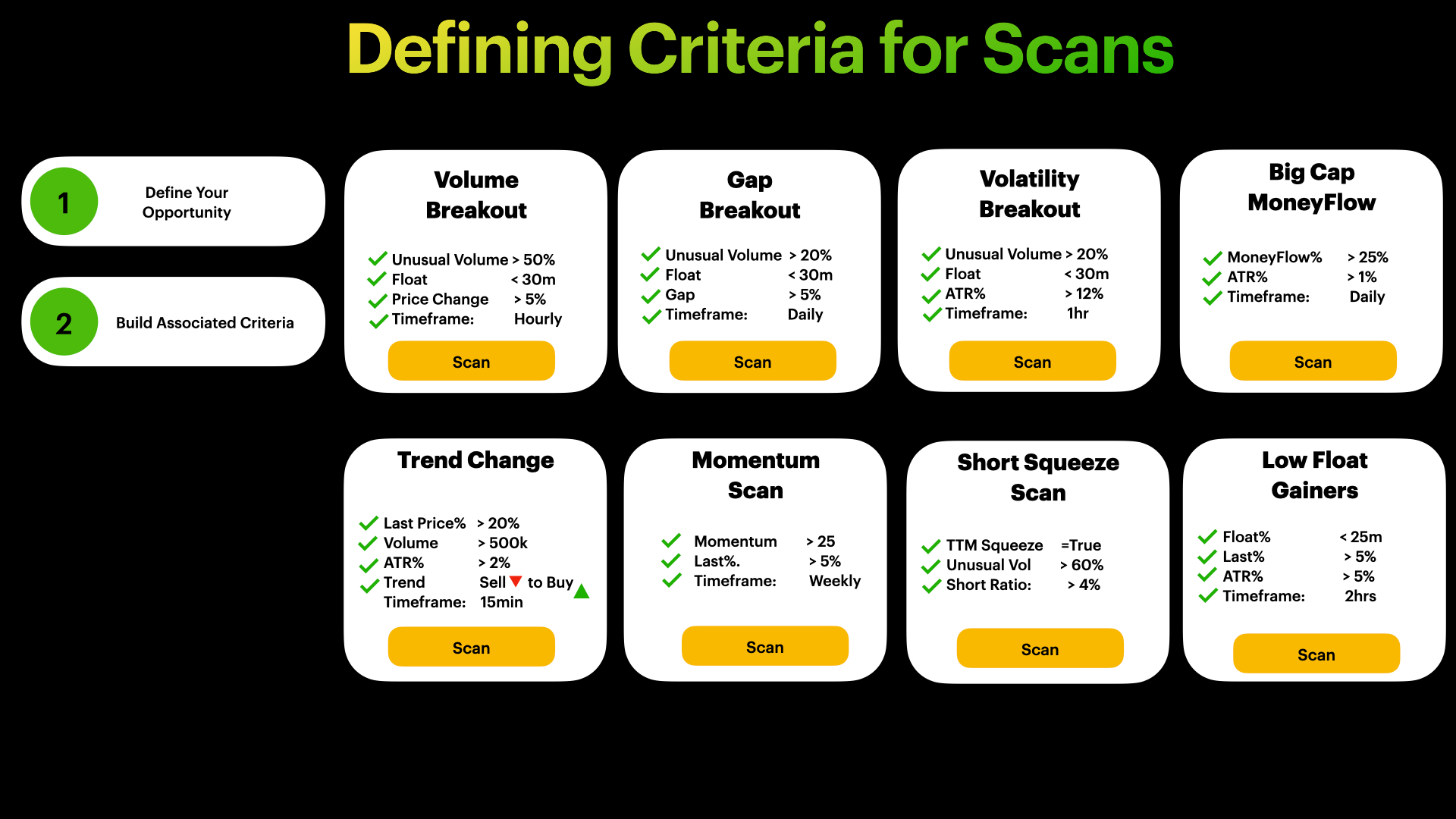

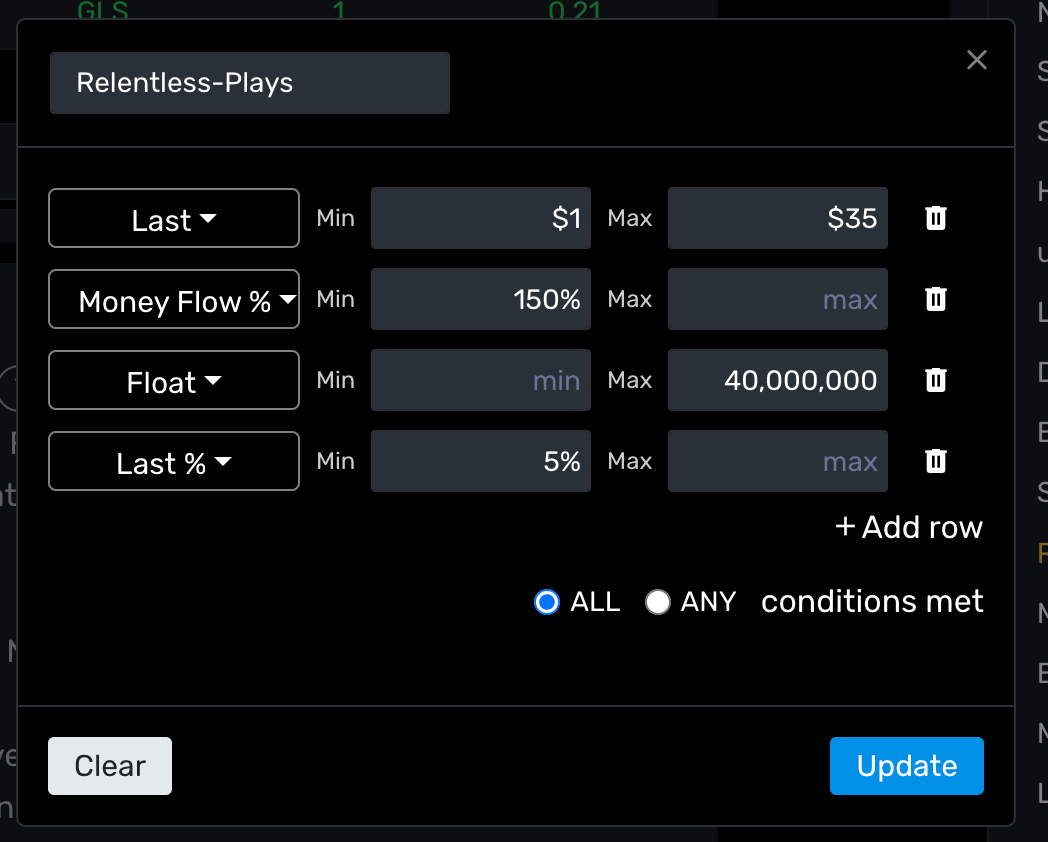

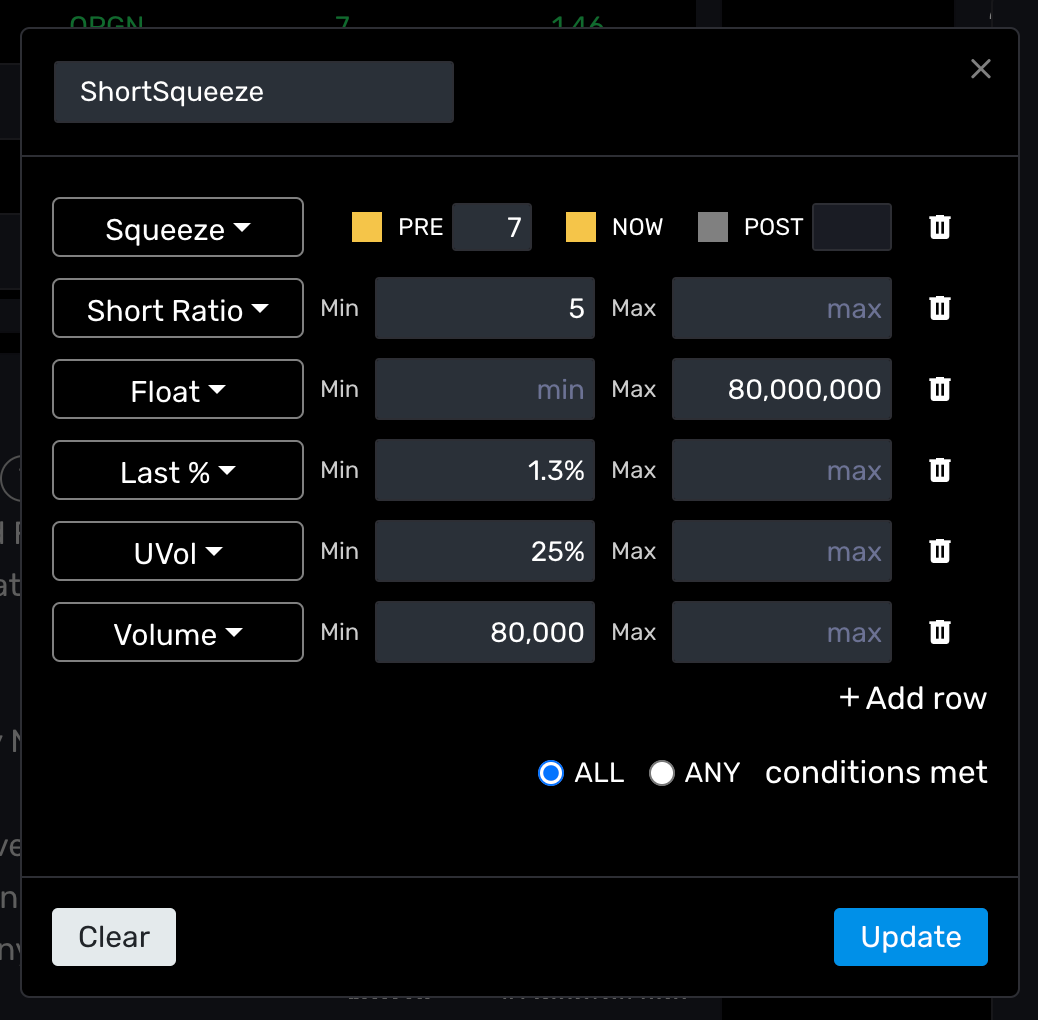

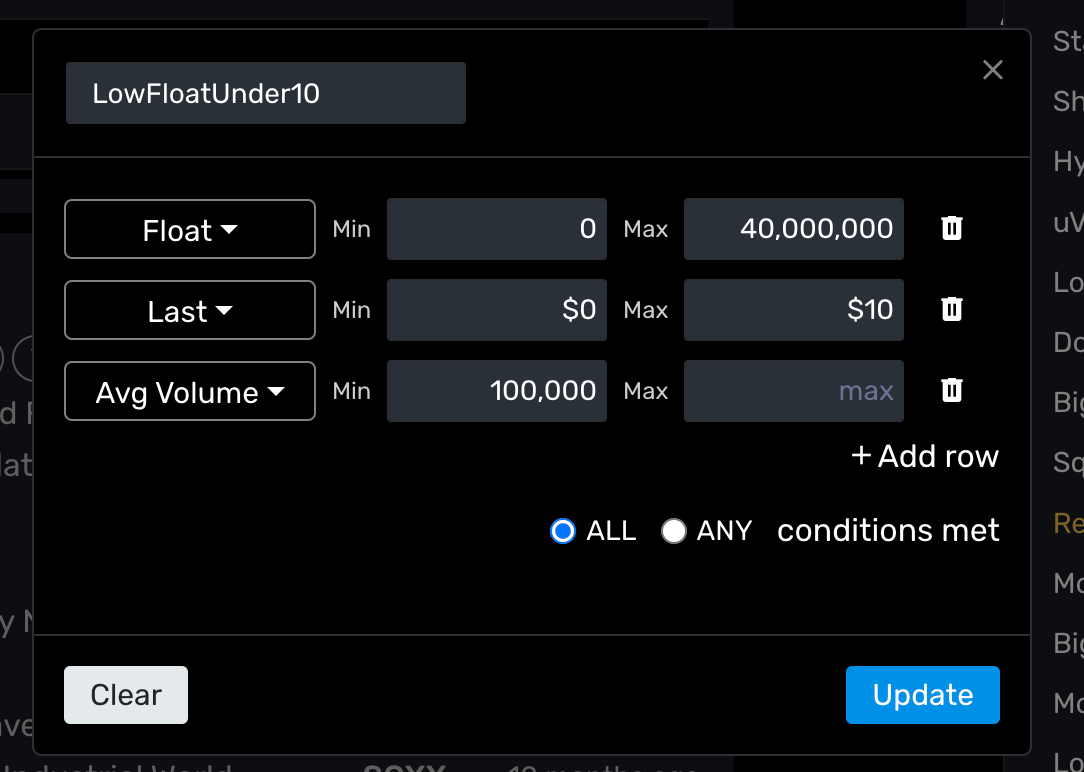

STEP 3: Translate These “Opportunities” into Criteria

Once you define the kind of trading opportunities you’re searching for by defining the set-ups, it’s time to translate the set-ups by the individual components quantitatively. It’s important to be very specific in order to attain precise candidates.

For example, you can’t just tell a scanner to look for “breakouts,” “good opportunities,” or “stocks making biggest moves.” You need to find a way to categorized your best trades into quantifiable scanning criteria.

STEP 4: Start Building Your Scan

Once you’ve defined your set-ups, it’s time to input the criteria into your scanner. Make sure you specify the time frames. Intraday trading can utilize frames utilizing hourly (1hr, 2hr, possibly 4hr) or minute (e.g. 15min 30min) signals. Swing traders can utilize wider time frames like the daily, weekly, and or monthly. All this depends on your approach and is certainly not a rule.

STEP 5: Test, Analyst, and Repeat

After building your scan, make sure to monitor each stock to gauge the accuracy of the scan.

As you go review the results, make sure to note which candidates continue to follow through on the set-ups and which end up being false positives.

Keep in mind a scan is the only the first step. Timing, position management, and exits are a major portion of the overall trade execution process. Using a the right scanner that is refined to your style and risk tolerance is similar to having the right sporting gear for your skill level. For example, probably not a great idea to hunt out highly volatile trades if you cannot be 100% dedicated to watching the position.

Over time, examine the criteria to find out what component was lacking in order to refine and improve your trades. The goal is to continue to refine your scans to produce the finest qualified candidates ready to trade your methodology.

Final Thoughts

Using a stock scanner is to enhance your agility and efficiency as a trader. It takes effort to build scans which align to your trading style, but by doing so, it dramatically finetunes your hunting for plays while giving you much faster entries. Trading is chaotic enough and you don't need to disjointed tools and noise complicating your efforts. Most importantly, don’t spread yourself too thin by hopping on every break. This is a common pitfall for beginners.

At times, scanners can make you feel like you have superpowers in the right market, until the market turns and you are caught on wrong side. Scanners are only a part of the trading process. Lastly, traders don't need a scanner - they just trade a small handful of stocks and play the trends. But if you want to know the breadth and pulse of the market scanners can reduce the chaos, get better entries and let you do your job day in and out.

New to MOMO Pro? Sign up at Mometic.com