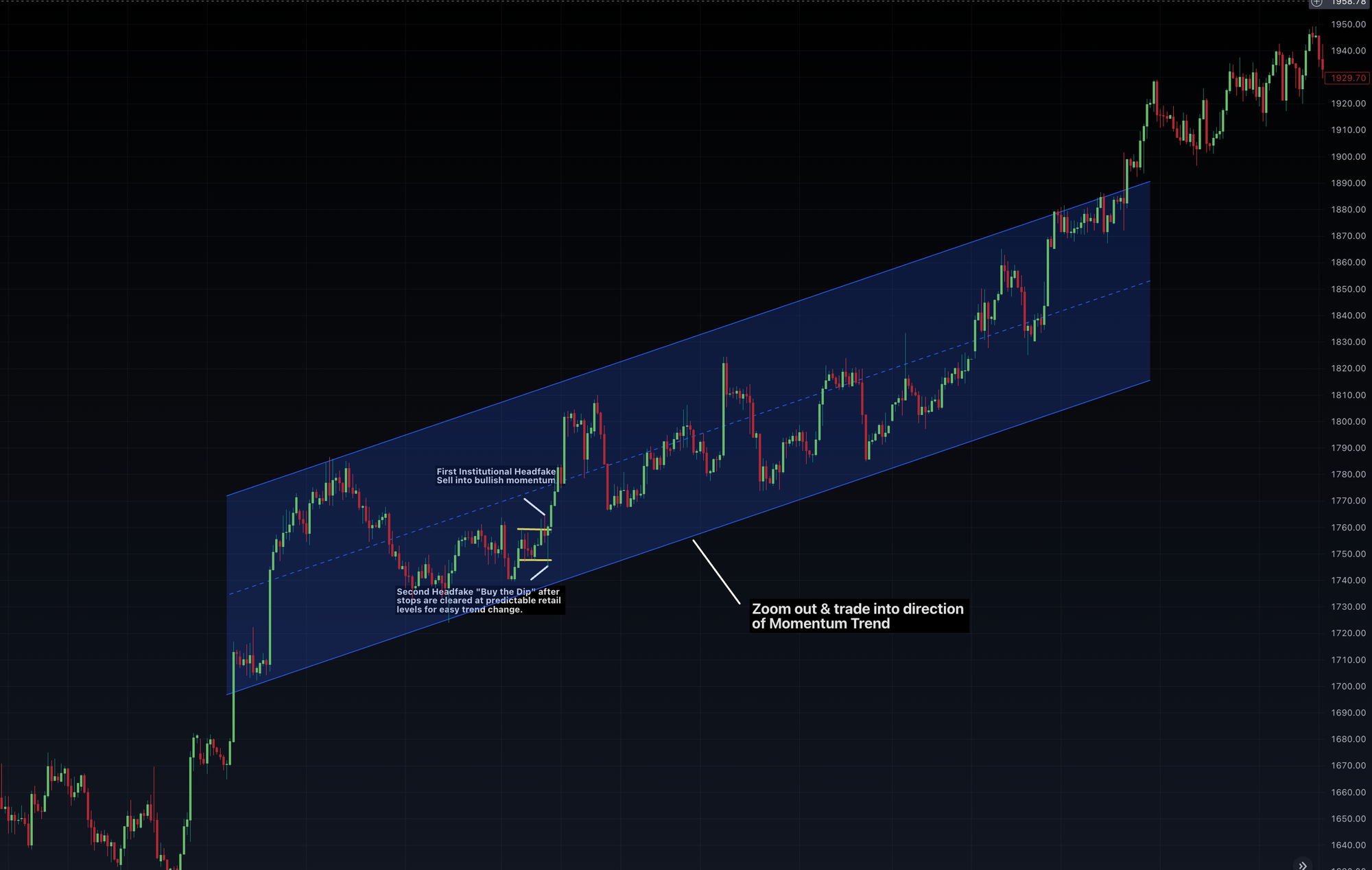

Outsmarting Institutions by Mastering the the "Double Liquidity Headfake"

The "Double Liquidity Headfake" is a common trap used by smart money to deceive buyers and sellers in a single progammed play. The event occurs when the market breaks a swing high or low and then reverses in the opposite direction, trapping traders on both sides. By identifying this pattern correctly, you can capitalize on one of the best smart money setups.

The Double Liquidity Trap:

- False Breakout Patterns: The trap starts with a breakout that fails to continue beyond a level, resulting in a 'false' breakout. These patterns are essential to learn because they often indicate that a momentum move might start soon. Trading is a game of deception, and learning to play accordingly is crucial.

- First Liquidity Headfake: Price breaks a swing high and quickly reverses, deceiving buyers who took the 'bait' of the breakout. Professionals then push the market back the other way.

- Second Liquidity Headfake: Price falls, breaks a swing low, and traps traders on the short side. This clear-out targets 'weak hands' in the market, such as traders who take positions when a market is extended or try to predict a breakout from a key support level too early.

To avoid falling victim to this trap, you can trade in the direction of the initial false breakout after identifying the double headfake setup. This trend continuation setup requires discipline and a bit of gut feel to know when it is likely to occur - but if you held off you are at least not getting stopped out and getting a better entry.

Trading the Double Liquidity Headfake in Various Market Conditions:

- Trending Markets: The best way to trade the double liquidity fake pattern is in line with a dominant trend. In these scenarios, the initial breakout direction often resumes after the second headfake, and traders with weak positions get flushed out (buy the dip).

- Range-Bound Markets: In range-bound markets, liquidity flushes are common as traders try to pick the breakout of the range. You can wait for flush at both the support or resistance boundary of the range and then trade back in the direction of the first false breakout.

Entry Methods and Identifying the Flush:

- Pin Bars and Large Wicks: These can help you identify liquidity clear-outs and time your entry. Set your stop loss below the bullish pin bar or above the bearish pin bar.

- The Psychology Behind the Pattern: Understanding the psychology behind the double liquidity pattern helps you recognize why it often reveals that smart money is behind buying and not retail "weak hands." After the first aggressive liquidity clear-out, retail traders are discouraged from buying, which means strong buying after the second clear-out is more likely a smart money participant.

- Utilize MOMO Trend to utilize trend change. It is volatility adjusted and can truly help account for when the trend has changed beyond resistance/support normally relied upon.

- Employ longer Momentum timeframes. Look past the 15 min and move to 4hr and note continued strength. The more bullish (bearish) timeframes aligned the better.

- Utilize Level 2. This can help if the orders are not hidden or dark-pooled which is not likely.

Accumulation, Manipulation, and Trend Phase:

- Accumulation: This stage is where smart money enters their positions. It is often characterized by a ranging-type market where the price moves sideways.

- Manipulation: This stage is characterized by false movements, with retail traders taking positions when they see a potential breakout. These traders then get caught in the second liquidity flush. I don't like the negative connotations of the term "manipulation" necessarily in this case, but its being managed or planned as part of a strategy

- Trend Phase: At this point, the institutions have accumulated their position and "manipulated" the liquidity zones to maximize profits. Now the investment houses, hedge funds, etc. will try to push the price in a specific direction, initiating a market trend with favorable entries.

Why do Institutions do this, if Buying the Trend?

Mastering these headfakes requires charting and live trading experience, By understanding how institutions can control the market, you can identify the direction of the market trend that they are trying to push and follow it after the second liquidity flush.

Institutions have many vehicles to lever the market, options and futures while available to retail are owned by institutions. Controlling markets with these provides many dimensions to their efforts. Nonetheless, they do this for profits of course and their traders are not using their money. So they don't suffer from emotions from chasing, but suffer from not following their training and earning their annual bonus. Further they have the firepower and driving liquidity is necessary to get entries from visibiltiy on scanners and charts.

Knowing how retail trades provides the necessary liquidity to improve banks win rate. Behind the scenes the play may come from a bank's customer needing a sizable position. Not knowing the future banks don't want to hesitate over days, but want to get a good entry, driving stops to kick off a small drop can help get the customer in and maintain a profitable trade for when the customer sees the order execute. It's banks best interest to show it "green" as soon as possible. (Would an investor be happy to see every trade done with a particular bank down $500k from poor entries 2hrs after execution? Perhaps start to wear down the relationship? Probably so!)

Closing thoughts

Typically, this action occurs in the 15min to 1hr timeframes and as a scalper you can capitalize accordingly. Swing and momentum traders already in the position who get understandably anxious seeing the drop can either maintain confidence that its a brief liquidity shakeout, look to add at the drop, or sell the first over-extension (shown below). Additionally, indicators such as ATR should provide some relief as the increasing volatility should increase odds of bounce, if not full recovery.

Adopting trading strategies in line with those of the big players will help you win more consistently. Psychologically the challenge is buying when there is no excitement vs. chasing FOMO. Lastly, here is a tip if already in the trade - at that 2nd flush, take a bit off the trade or average in with a small position (having considered current book, macro, etc.) Taking control of the position helps mentally.

Trade better with MOMO Pro. Get started here.

Brent @ Mometic