Introducing MOMO ORB

The ORB (Opening Range Breakout) strategy is considered time-tested and widely used approach that was originally devised in the 1960s by renowned trader Arthur Merrill and has retained its relevance to today. It's described as a "common trading strategy" that's attractive to momentum traders because entry and exit points are clearly defined, leaving no gray area and little room for obscurity — it either is or is not.

Over the past year or so, the strategy has to be experiencing heightened popularity, where we would get traders requesting several times a week. Some of the reasons we speculate the renewed interest is possibly from 0DTE (zero days to expiration) traders who use the breakout as a buy or sell signal, Stock traders focusing on liquid large-cap stocks and ETF, Traders looking to have defined and easily executed trades in early day.

We've been hesitant to implement as we didn't have a clear approach to do so and that every approach we considered required a non-trival amount of computing resources 3x more than we have deployed for any other service. Until now...

MOMO ORB Explained

If you are new to ORB – it is know to have proven profitability in liquid markets: The ORB strategy has consistently been profitable for the last decade when traded on large ETFs such as SPY and QQQ. As such, it has academic validation — A 2024 academic study "A Profitable Day Trading Strategy For The U.S. Equity Market" by Carlo Zarattini (2024) analyzed over 7,000 US stocks from 2016-2023 showed significant benefits when limiting day trading to "Stocks in Play pushing out of opening range".

Core ORB Strategy Components

Opening Range Definition: The ORB strategy identifies the highest and lowest prices reached during the selected trading range.

Entry Rules (Directional): If the first 5-minute candlestick is bullish (closing above its opening price), the system only takes a long position upon breaking the high of the range. If the first 5-minute candlestick is bearish (closing below its opening price), the system only takes a short position upon breaking the low of the range.

- 5-minute ORB on top 20 Stocks in Play: 1,600%+ total return, 2.81 Sharpe, 36% annualized alpha

- 15-minute ORB on Stocks in Play: 272% total return, 1.43 Sharpe (still good, but dramatically lower)

- The 60-minute ORB performed best with a win rate of 89.4% and profit factor of 1.44

- Base ORB on all eligible stocks: Only 29% total return, 0.48 Sharpe

Weaknesses:

- Declining effectiveness: Recent backtests show that the ORB's effectiveness has declined due to its widespread use, and traders are now using additional filters and integrating broader market trends to improve profitability

- Market condition dependency: The strategy is vulnerable to false breakouts in choppy or low-volume markets and is less effective in sideways markets when there's no strong directional bias

- Requires optimization: Performance varies significantly based on timeframe selection, opening range width filters, and market conditions

Comparison to Other Strategies

Among day trading strategies, ORB ranks solidly in the upper-middle tier. It's more accessible than complex strategies like order flow trading, but potentially less reliable than optimized momentum or trend-following strategies in certain conditions (Watch for mean reversion as well as options strikes).

Key advantages over strategies.

- Extremely straight forward - simple to follow and implement without ambiguity.

- Clear, defined entry/exit rules

- Minimal indicator requirements - don't need obscure EMA crossovers, or customized studies to validate.

- Works across multiple asset classes

ORB is a highly popular, beginner-friendly strategy with proven historical effectiveness, but its awareness can reduce its effectiveness - particularly if you don't have adjustable ORB windows, like ours. Success also requires additional filters, proper market selection (focus on high-liquidity assets with news catalysts), and careful risk management. With that in mind, ORB remains a solid strategy.

Why ORB is Awesome on MOMO Pro Ultra

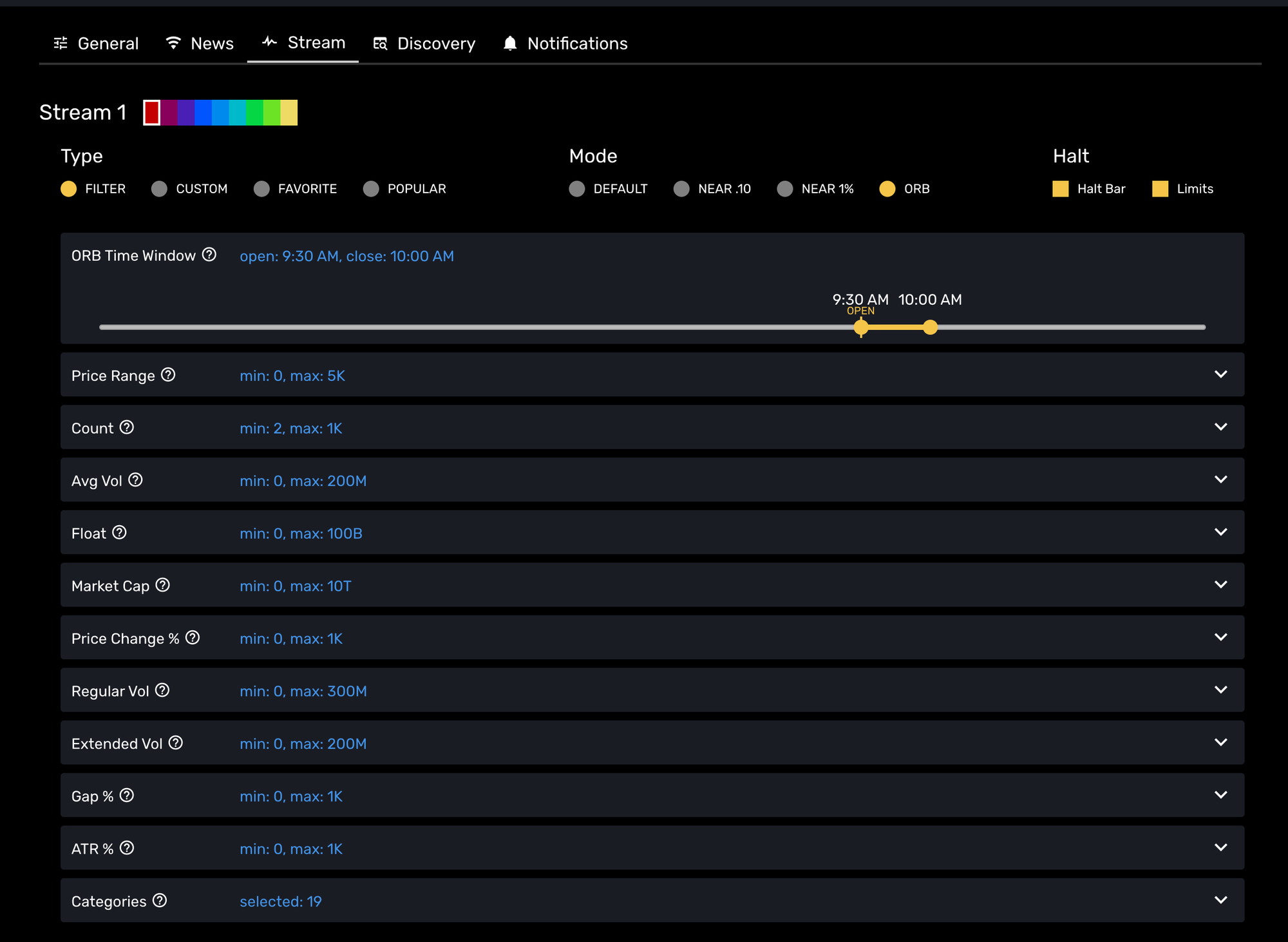

MOMO Pro Ultra implements ORB in a realtime basis such that you can define and tweak your timeframe (ORB window) on any 5 minute range prior to 12pm EST - including pre-market.

Meaning you can set a window from 5 min prior to open to say 30 min after for a 35min range if so desired. Set as it makes sense for your class of stocks.

Additionally, as shown above you can include all your price, float, volume and other criteria AND even upload your own custom list of stocks or chose from our various supported Types.

Once set you receive realtime breakout scan off any and all stocks breaking out of your set MOMO ORB range.

Additionally, there is a special capability which lets you leave your opening value UNSET and set the closing value. In doing so you get any stock that is just breaking out of closing time. Meaning you are effectively resetting the new HOD / LOD logic to set time - such as market open.

For example, when you only set the closing range to 9:30am EST you are going to get all new highs and lows which occur starting at 9:30, NOT from prior's day close!

We are excited to hear feedback on MOMO ORB! If you are new to MOMO Pro Ultra? Learn more here!