Why Product Innovation is Challenging for Both Inventors and Investors

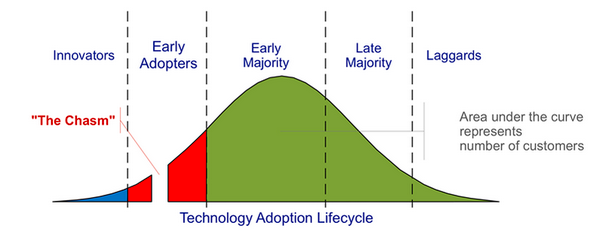

We have seen the technology adoption lifecycle in its full glory, which includes the notion of using a success-failure “chasm” to determine whether a product is market fit.

However, the challenges an innovator faces throughout this journey are shadowed in mystery. Investors and traders could benefit from knowing the “when” and “why” to make pragmatic decisions throughout these technological lifecycles.

The real challenge is constructing something that has a “trojan horse” market strategy, unfolding and dovetailing in a timely way that can not only cross that success-failure chasm but can increase momentum to meet the demands of even the most impatient investor.

This is significant because building tomorrow’s Machine Learning, Quantum, or Blockchain widget may be years or decades coming. Even possessing a solid go-to-market strategy that meets market demand while spearheading a dominant hype cycle is no easy task. Failure to do so will result in businesses stagnating and floundering on all fronts, perhaps even "failing" from the market perspective.

It is frustrating to witness an innovator losing energy and enthusiasm as a result of these struggles, leaving an opening for a private equity firm to swoop in and snatch up the pieces of unrealized vision. Yet, at that time, what seemed like a failed vision was redeemed as others carried forth that vision to meet potential success.

Investors, whether a VC or public trader, face similar challenges. Ideally, they want to see financials providing evidence of product-market fit (PMF), typically "post-chasm". However, it is an issue of contention that during this point, the innovator would not require money as they would be on the verge of becoming cashflow positive.

Shark investors play this rather silly game (including those on Shark Tank and The Profit) as an attempt to squeeze businesses that they know have not crossed the chasm and do not possess the financial runway to make that happen.

This mindset is akin to a property investor who views situations in linear growth rates.

Sharks play this game because the innovator can't elicit future opportunities. This is the reason California has proven so successful with startups and entrepreneurship; the VC’s on Sand Hill Road in San Francisco recognize that there is significant runway and risk involved but know that they can realize returns of 100 to 1000 times their investment. Therefore, they are more willing to invest at the concept level than post-chasm.

This is a familiar problem at the product level within businesses as well. There is a disconnect between investing in innovative ideas and the operations/sales daily focus. In many zombie corporations management will not risk investment due to these constraints and unknown variables.

This situation is a small ball, "Catch-22" scenario where managers and investors hesitate to such extent that they eventually acquire a short term metric for validating their decisions.

If an investor understands the product and Total Addressable Market (TAM), they can invest in snowballing momentum, which lurches valuations above financial models, providing significant returns in contrast to the post-chasm "when it makes sense" phase.

So, what is the point?

Well, the initial catalyst for MOMO Pro was to discover businesses on the cusp of being "found" by the market and uncover their background, goals, and other intrinsic characteristics.

While many use MOMO for scalping, swing trading, and other ventures, it is still an amazing way to uncover new biotechs, securities, clouds, and other high-tech businesses on the brink of a major breakout.

Still don't have MOMO Pro yet? Learn more at Mometic.com

//Profit from Momentum with MOMO Pro

MOMO

We are dedicated to making financial data more accessible. MOMO Pro is an integrated scanner and screener designed for any device.