My Zen Trading Setup

MOMO Traders -

At any given time, I have 50 to 75 stocks from which I am monitoring either to scalp, swing, add, or close positions. This doesn't include the new discoveries I uncover with MOMO that are either rips in MOMO Stream or are "lying in wait" from unusual volume, squeeze, news, or a combination of above.

As original MOMO subscribers know, MOMO started out as a HOD/LOD scanner years ago but has evolved and now provides a comfortable, yet dynamic environment that keeps tabs on positions important to me, but also keeps me from feeling any FOMO whatsoever. In a nutshell it's my "Zen trading setup" and I has contributed greatly to my profits and overall confidence.

In defining a Zen-like trading environment, I believe you need the following:

- Tool to identify potential opportunities vs. chasing news, social media pumps, and the like.

- Ability to filter out the distractions. Having a Zen setup is not about being boxed into just a watchlist, but having a mechanism to consume new ideas in my desired format and pace.

- Curates opportunities and lets others do the work for me. Our brains are very selective and if others are taking notice it puts an exclamation point for me to track.

- Have metrics and indicators which identify recency of move and strength of move and potential reason for move (e.g. News, if available)

- Easy way to add and remove stocks and add as an alert to keep in focus when it matters. Many systems require way too much effort to do this simple task and I either get lazy or forget about a potential stock I want to track.

- Removes outside emotion and influence. Taking action on social media posts is not profitable. Deep learning AI tools cannot untangle sentiment in a profitable way and I'm not going to try either.

- Develops my own cadence and trading pace. Again social media, chat rooms and such creates a frenzy but is largely a game of musical chairs, as-is trading to some extent, except you don't know when the music started. My Zen trading setup lets me consume on standardized pace and build around that.

- Gives me flexibility to stay connected on mobile with similar experience and not have to hurry to start up my trading account, etc. (which takes a ridiculously long time despite the performance of my computer).

Personally, having MOMO Pro has allowed me to find winners before they make major moves and before others take note and keep tabs on what my stocks are doing over the duration of my interest.

Here are some guidelines of my MOMO setup – keeping in mind MOMO is built from ground up for momentum so perhaps a bit redundant.

Now these are my settings based on how I view the market from a lens of momentum as I am a momentum trader. Everyone has their own duration and risk profile, and I have historically refrained from saying one MOMO setup is better than another.

- Performance: I like stocks which have had outsized moves in the past or had promise of huge market opportunity. I add those plays to my favorites. Examples include themes like 3d printing, oncology, metaverse, biotech (viral and non-oncology), Alzheimers, quantum, semiconductors (broader chip view), payments/crypto, etc. Obviously some overlap, but some spaces breakout harder than general groups. And having the nice favorite ⭐️ to highlight stocks of interest forces me to take note (whether the stock is going up or down).

- Money Flow: Tracking the stocks by having a minimum money flow or market cap (defined in MOMO with min. Float and Last price filter) allows me to not waste time on junk trading with low interest or market cap. A lot of these small caps are driven less by demand and supply but more by chat room pumps and dumps and again, hard to know when the music stops when you didn't get the initial VIP invite.

- Squeeze Potential: Is the stock breaking out of a consolidation pattern and ripe to catch the attention of others if it breaks. And if it already is breaking out, how recent was the move. These moves are usually outsized and worth watching. (note: you should take these gains within a day or two as shown from machine learning backtests if viewing Squeeze on Daily and day trading them as opposed to swinging)

- Unusual Volume: Works hand in hand to validate squeeze. Where the % change may not be moving but volume is indicating bubbling interest you can be poised for the breakout as volume is eating through walls of resistance, but the move hasn't occurred yet materialized.

- Others of note: VWAP, Momentum, Float, Avg Vol. These all play a part too depending on what my interest is. VWAP % is good if I want to see how overextended something is and if I should be cautious and or even short the play. Momentum is great for vetting out spikes and showing a true trend.

Putting this all together: All said and done, all of the indicators work really well for me - which makes sense - I designed it. But really, MOMO lets you toggle and sort in many different ways to let you vet data and in general, tries to keep you from going astray.

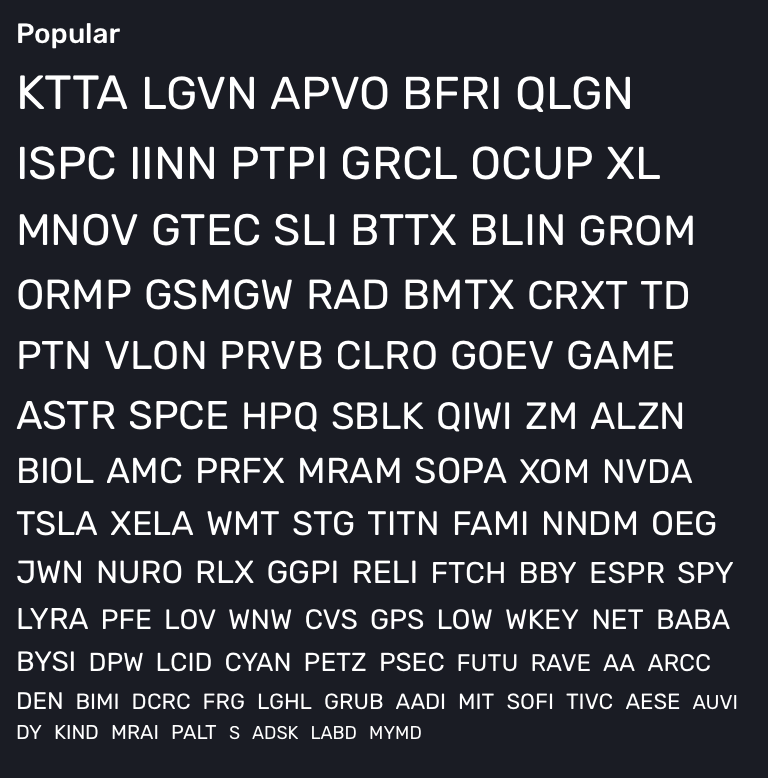

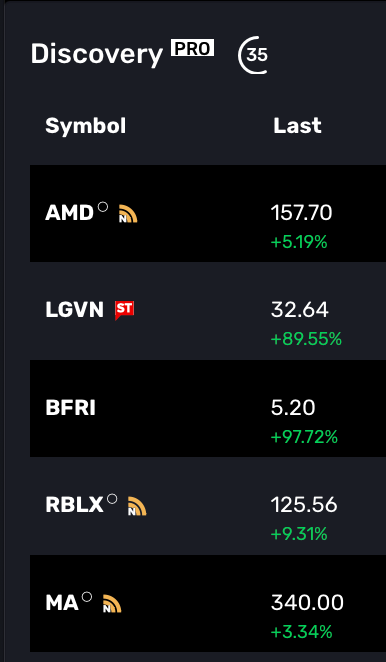

Add in News, Popular and Stream and you are getting a 360 degree view of what has been moving (Discovery), what is currently breaking out (MOMO Stream) and view what is capturing the interest of other MOMO traders (Popular) as well as associated breaking News and also socially trending indicators you are sure strike that perfect balance in managing existing positions while consuming new opportunities.

And don't forget - we have a hidden easter egg which you can download your screen to CSV for further analysis.

Certainly there are downsides? Sure. The biggest challenge is getting too many winners to the point you think you are in "God mode" and then either don't close out the positions per my personal process (get the belly of the trade) or you get sloppy from success. Over time, I've seen my success dwindle after a couple of strong months in a row. This is probably due to one of the many cognitive biases which make me think I can't lose or am overly entitled. It's also due to trying to fight upstream when I know the market is softening as a whole.

Sign up or learn more about MOMO Pro at Mometic.com

If you liked this post, don’t forget to share as it lets me reach more traders like yourself :)