Why MOMO Pro Provides a "Flattened View" of Regular and Extended Hours

A recent MarketWatch article shed light on an intriguing aspect of the stock market that we have known for several years and have been meaning to share: a significant portion of daily returns are made outside of regular trading hours.

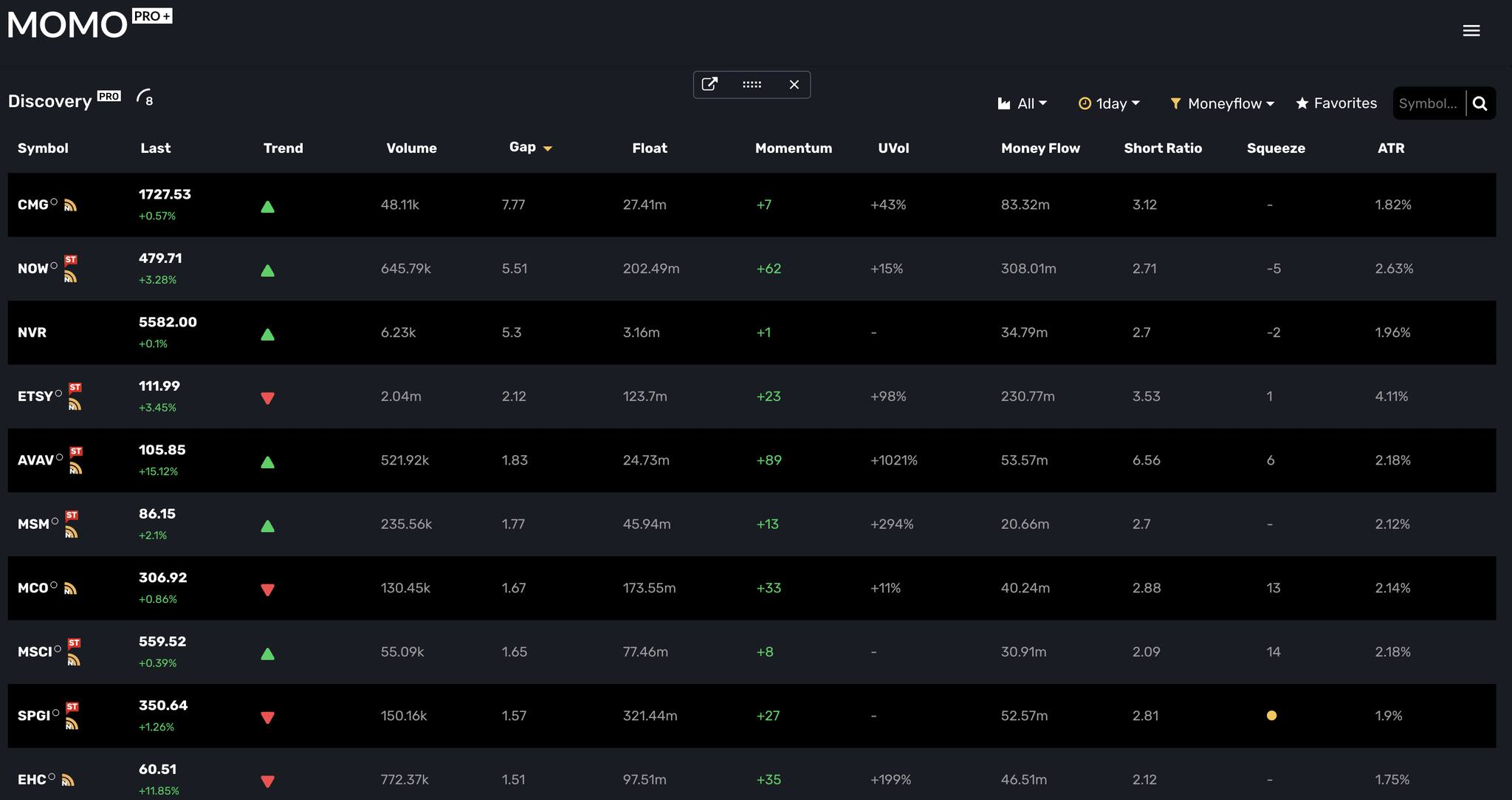

As the founder of MOMO Pro, I believe it's essential to provide our users with a seamless view of the market, incorporating pre-market, after-hours, and regular trading hours data. Our platform is designed to help investors capitalize on the moves that occur outside of regular market hours and identify potential trades as easily as regular market hours. In this blog post, we will discuss the findings of the article and explain how MOMO Pro's seamless view and Gap logic help capture these often-overlooked opportunities.

Off-Hours vs. Regular Hours Trading Pattern

The MarketWatch article highlights the U.S. stock market's historical tendency to make most of its daily moves overnight, between the closing and opening bell. Multiple academic studies confirm this pattern, including research by Oleg Bondarenko and Dmitriy Muravyev, and another study by Terrence Hendershott, Dmitry Livdan, and Dominik Rösch.

Bruce Lavine, founder of NightShares, stated that three-quarters (75%) of the 9.7% annualized return produced by the SPDR S&P 500 ETF over the 20 years through the end of 2022 occurred while the NYSE was closed. The Russell 2000 Index exhibited an even more pronounced pattern, with all of its net returns produced overnight.

How MOMO Pro Seamlessly Monitors After-Hours Moves and Identifies Potential Trades

MOMO Pro is designed to provide investors with a seamless view of the market by incorporating pre-market, after-hours, and regular trading hours data into a single coherent view. This comprehensive perspective enables users to track and analyze market movements beyond regular trading sessions, ensuring they don't miss out on action during these hours typically neglected by media and other classically designed tools.

Our platform offers real-time data across 100% of the trading hours allowing investors to quickly identify trends and make informed decisions based on a more complete picture of the market. MOMO Pro's customizable alerts and filters help users stay up-to-date with market movements and act swiftly to capture potential gains.

MOMO Pro's new Gap logic is an essential tool that enables users to see significant moves and identify those skewed market gains that have been seen in the noted research. While investors may miss a portion of the move, as the article suggests, the Gap logic helps them recognize opportunities that may still be profitable trades.

In addition, our platform is designed to be user-friendly and intuitive, making it easy for investors of all experience levels to navigate and utilize the wealth of information available. With MOMO Pro, you can be confident that you have the tools and insights needed to take advantage of the hidden gains that occur outside regular market hours. (It also reaffirms the value of swing trading, but we will leave that for another post)

TL;DR

The stock market's tendency to make significant moves outside of regular trading hours presents a unique opportunity for traders who are equipped to monitor and capitalize on these movements. MOMO Pro's seamless view and new Gap logic help investors uncover hidden gains and make more informed decisions by providing a comprehensive view of the market, including pre-market, after-hours, and regular trading sessions. By using MOMO Pro, you can stay ahead of the curve and maximize your investment potential in today's extended, fast-paced market.

The Gap scan is only available as part of MOMO Pro+, so if you are a MOMO Pro or MOMO basic subscriber you will need to upgrade.

Don't have MOMO Pro+ yet? Start here!

Brent @ Mometic