Why I use TXN as a Market Indicator

Texas Instruments is one of the driest tech businesses in the universe of stocks. By driest, I mean most basic, vanilla tech out there. Sure they invented DLP and other novel technologies, but the success of the business model verses degree of innovation is skewed. They have had very good fortune, whether in terms of luck or skill with A/D demands in past decade, but their ability to inject themselves and create customer stickiness is the real gem.

As someone who mostly trades momentum swings, TI's bias is useful for filtering out the noisy signals on market direction. Sure you could use indexes (I do as well) but the stocks which interest me tend to be more on the tech side of things and the indexes include many different sectors.

Here are a few reasons behind my thinking –

Institutional "Purity":

TXN is 89.5% owned by institutions. As such it is not going to be heavily influenced by some of the short term events that cause market over-reactions.

Big money navigating all the factors and concerns should have highly educated view of the future incorporating many dimensions and outcomes via AI or otherwise. Texas Instrument's "boring" products are like water for growth, manufacturing and tech businesses and have exactly the type of run rate and staibility institutions like.

Global Political Climate:

With manufacturing plants throughout the world including China, they are susceptible to logistics and the various pitfalls of operating globally. Unlike other global businesses which are drama-ridden, TXN has history of being able to keep nose out of trouble for the most part - but if investors sense macro issues TXN will reflect the action.

Demand Drivers:

TXN is huge part of consumer and commercial demand. Product innovation in cameras, automotive, and manufacturing sensors is required many quarters into the future. Businesses which lock down these orders are seen in TXN earnings sooner than reflected in their downstream customer's reports. For example, if Apple requires a new circuit from TXN for an upcoming device, Apple is locking down the orders 6 to 12 months in advance.

Value of Money:

TXN has had history of buybacks and dividend increases which plays well into a managed stock philosophy, however, if cost of loans or other threats weaken the proposition. Coupled with their ongoing growth its on the contemporary side of a conservative play. When TXN faulters with this type of backstop, then there are looming market problems. These very institutional holders would have to really feel the 2-3 year outlook is bleak to take the tax hit and change their thesis; particulary since TXN is structured for long-term ownership.

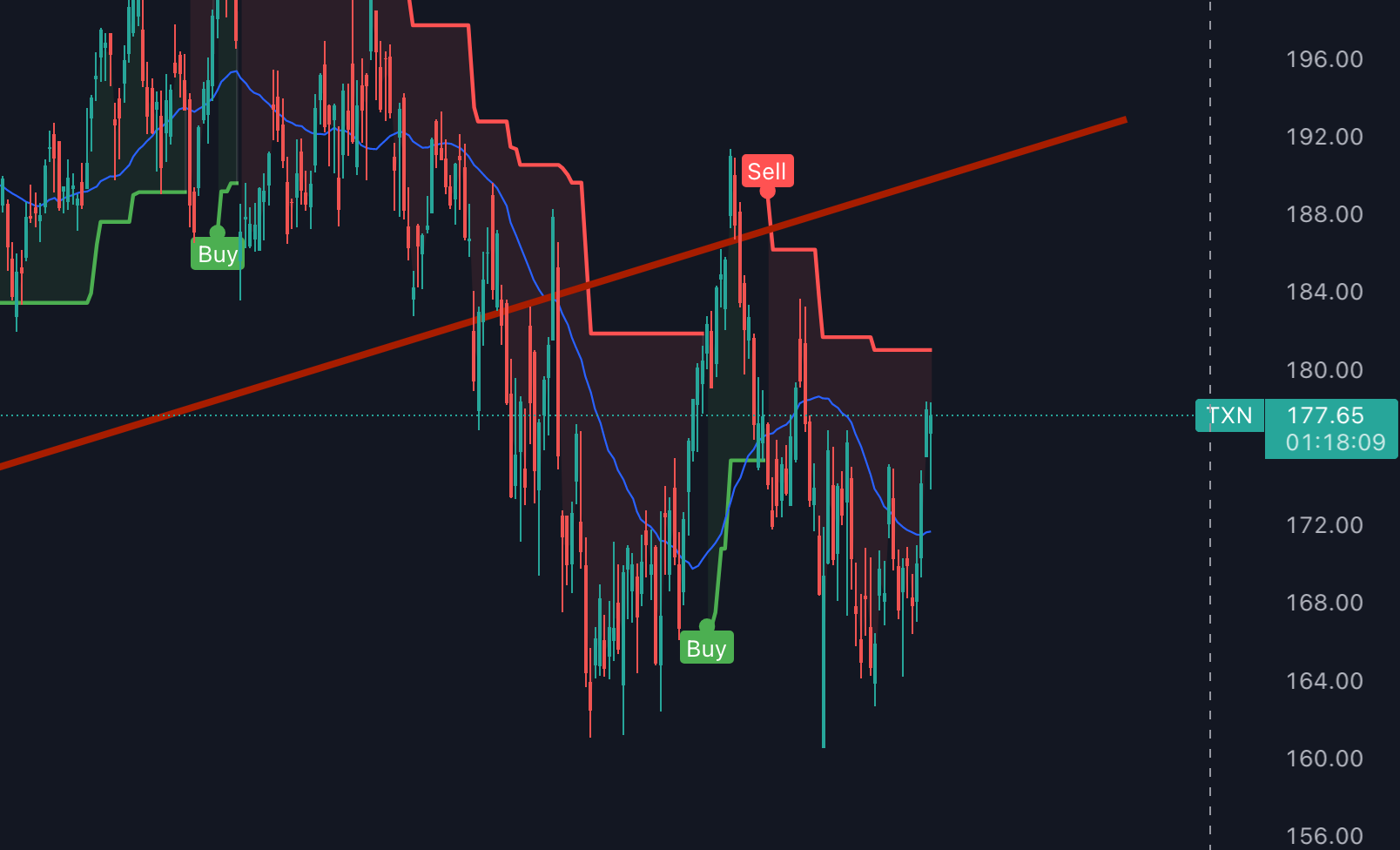

In looking at where TI stands price-wise it is actually slightly more bullish than QQQ, but lower improvement than some of the retail chip stocks over past 14 days (NVDA, AMD) and while more is better, keep in mind TXN is only down 10-15% from average highs where AMD and NVDA are down about 30-40%!

All said, if the TXN market gauge is reliable, the tech market is leaning towards the optimistic side. Additional validation would be if price gets over $179 and would become fairly pessimistic if it closes under $172. The diagonal trend line is a long-term trend line which is demarkation of exuberance vs. long-term trend channel (7 years).

What do you think? Agree or Disagree? Drop us a message if you have more to share.

Happy Trading!