Available Volume Options for Uncovering Liquidity and Unusual Activity.

We have a love/hate relationship with volume (many things, but volume in particular). In fact, initial versions of MOMO had no volume-based filters or data. Despite our belief about volume distorting breakout intents, we eventually buckled and embraced price's sidekick in a way which we felt aligned with our strategies but also met user's needs.

First off - why the hate for volume? Well - aside from great frequency where where stocks "melt up" or down with diminshed volume, we find it to be distracting, misleading, and at the same time an obvious artifact of trading. Persistant moves, even with smaller issues can creep slowly and stay under radar of the volume police. Institutions are going to establish a position and sneak in beyond volume radar either buying at VWAP, dark pool or other discreet manner.

Distracting - lying in wait to execute a trade based on volume confirmation is a mixed bag. If scalping and using L2 then you can trade based on breaks of the walls which is more precise than volume.

Self-fulfilling - trades with patterns, trends, and other breaks are going to drive volume and secondly as they break the trends, daily highs/lows and such stops are being hit - naturually driving volume. Is the fact that a trend break with numerous hidden stops going to provide a wealth of insight when volume automatically hits as well?

Misleading - Of the traders who look at volume, few ever mention or acknowledge the percentage of shorts leaning into the trade. If 25% of the volume is short and not recognized how does this validate the move?

Beyond our Philosophy - what can MOMO Pro do with Volume?

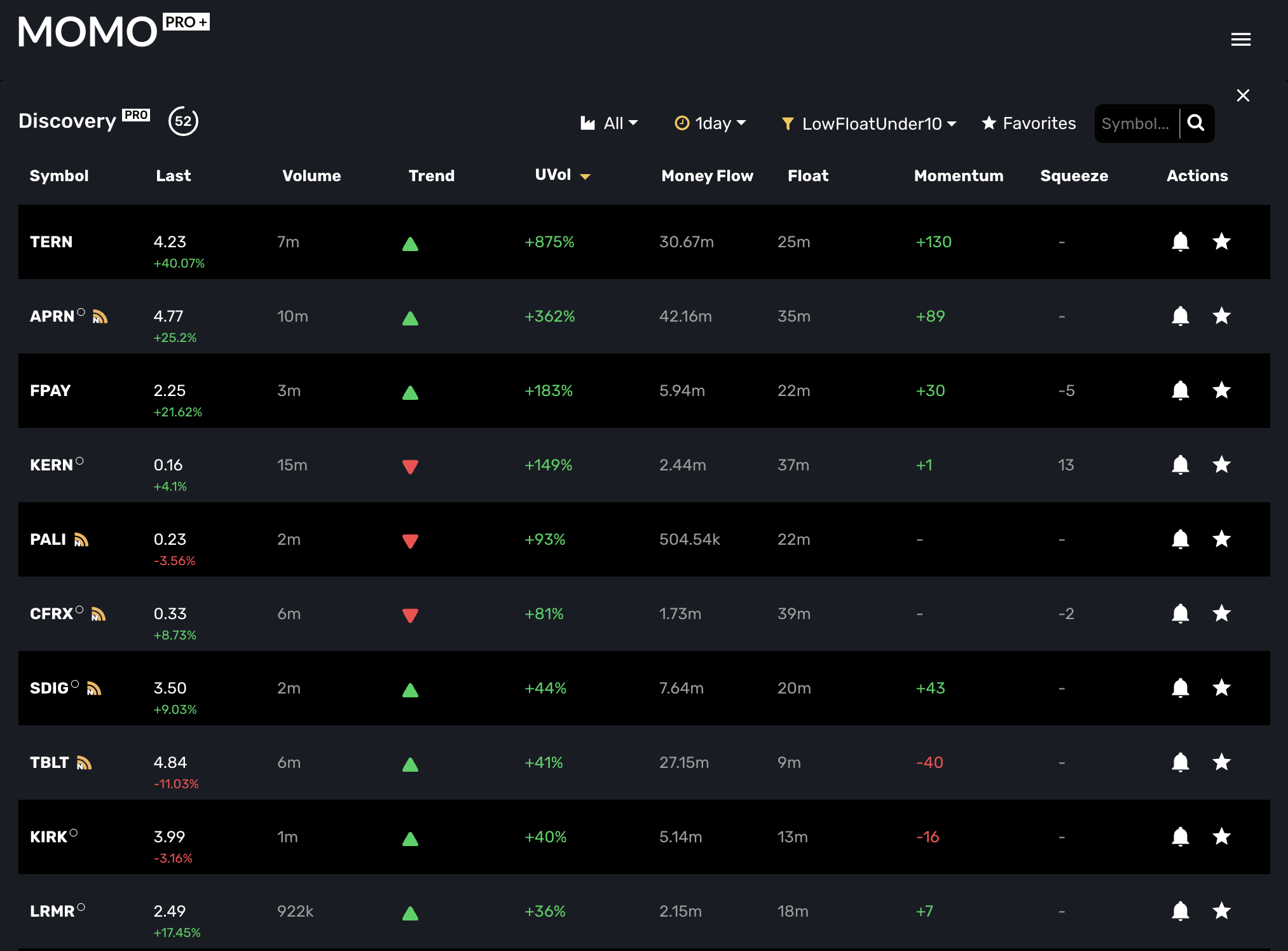

MOMO employs volume in 4 different ways. We think this is more than sufficient to uncover breakouts and interest. The following list details the depth of each and how they can be used.

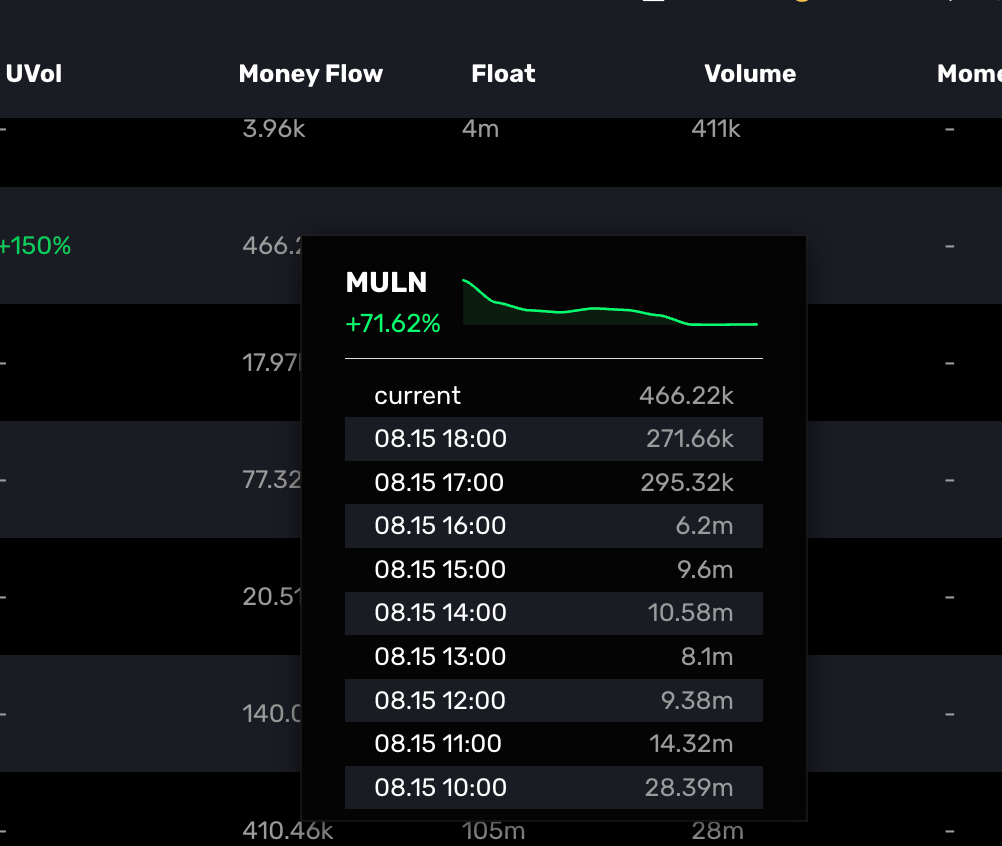

- Unusual Volume - (uVol) seeks to identify anomolous volume relative to prior 30days. Our uVol works by breaking up the day into 15min day parts from which it baselines current vol vs. average. This approach is more complicated than just looking at timeframes immediately preceding as they ignore standard distribution of volume throughout the day. You may sort in Discovery by uVol, filter, or build Conditional Alerts using uVol as a component

- Average Volume - is more of an attribute of a stock but is useful for elimintating illiquid stocks from view. Average vol is available as a Stream Filter and Discovery Filter as well as an Attribute for a Conditional Alert (meaning since it is relatively static, it won't trigger an alert like a % change in price could).

- Current Volume (visual only) - Is daily traded volume. We capture from pre-market open (4am EST). It is only shown in Discovery and may be sorted.

- Money Flow - Is the way we show investor interest based on money invested. This is very similar to how users apply volume to trading, but we instead allow comparison of stocks by showing Money Flow. With volume you may see 100 million shares traded on one equity vs. 80 million shares traded on another and think there is more meaning in the 100 million - when in fact the stock with 80 million shares traded is $30 a share vs. the 100 million share stock only is priced at $10. See the relevance? MoneyFlow is a Pro+ feature and is available in Discovery, as a Discovery Filter as well as available as a Conditional Alert.

NOTE* - Our volume incorporates darkpool volume. As far as volume goes regarding our stance above, this is powerful particularly for capturing unusual activity that may be slipping past other websites and basic scanning tools.

Don't have MOMO Pro yet? Learn more at Mometic.com

Team @ Mometic