Top MOMO Pro Screeners for Uncovering Winning Trades

Lately I have been getting requests for sharing the screener settings that I use for Discovery Pro. On any given day what I use varies depending on the overall macro market and how aggressive I feel.

Before I share my top screens - what's great with the new Discovery Screener is that you can sort these screens very quickly to find both long and shorts plays. For the most part I'm long although I do like a juicy short when it presents itself.(way overextended on VWAP%, Meme stock way over bought, etc.)

So here are the top screens I use:

Default Discovery Pro Settings: That's right, nothing but the default Discovery view. I know the market well and actually just sorting on Momentum or Unusual Volume columns (click on headings) shows me a ton about what's hot. I can then walk the timeframes to see what has moved the most in the last 15 min or look out longer timeframes to see what has held up throughout the day. Also, I can quickly tap the star ⭐ and see my favorites and sort as needed.

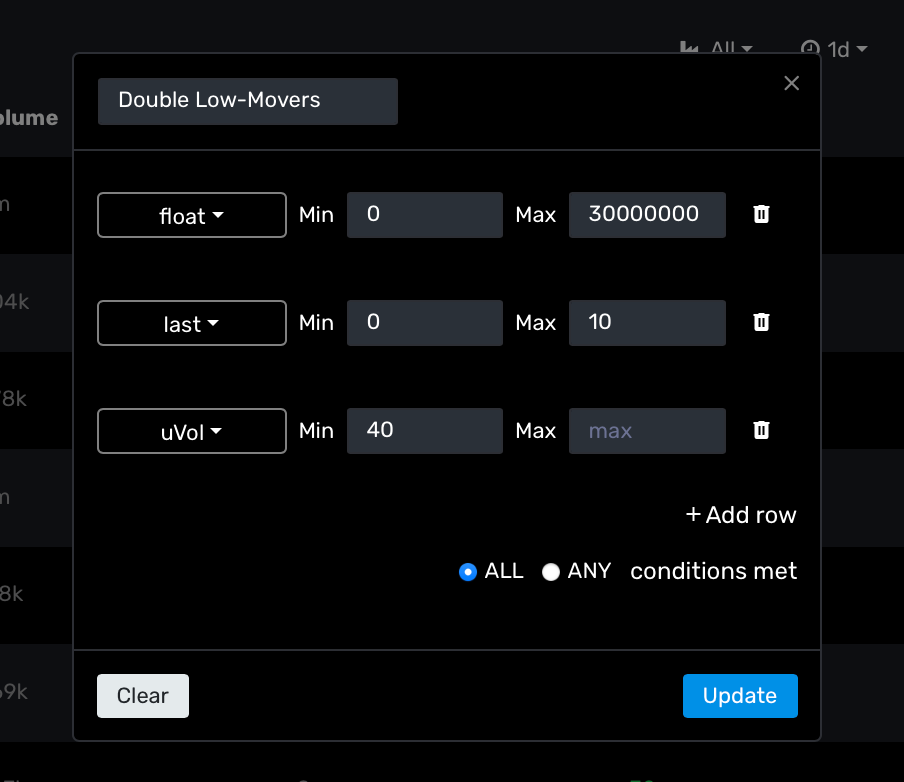

Double Low-Movers: The next screen I have saved I called, Double Low-Movers. (Low Float < 30m, Price < 10. and > 1, uVol> 40%). This scans for those low floaters ripe for a powerful move. Sometimes these will start bubbling up a few days prior to their move and I will swing them and the carry risk isn't too bad given the low price.

Here I sort and look for news on any of the listed stocks and see if they are going to rip. This is great scan for pre-market stocks with great potential to make powerful moves through the day. Stocks like NIO, VTIQW, (ok, and warrants) and BLNK all started out from this scan where unusual volume (uvol), just started going crazy. (go back and look at their prices in 2020 - all around $1- 2!) Found them with this screen!

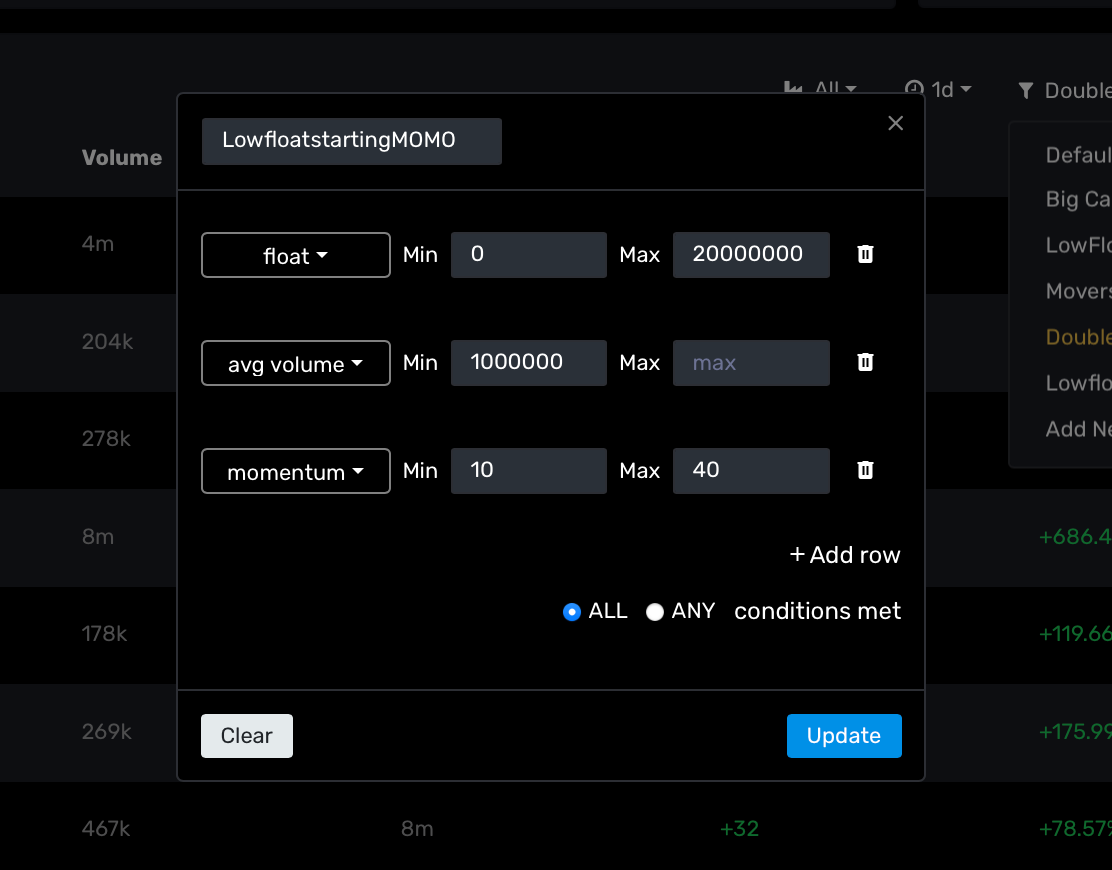

Low Float Starting MOMO: This screen is similar to Double Low Movers except this tends to find those low float stocks which are starting to move past resistance levels. Where Double Low Movers is good for seeing excitement or early interest rather, Low Float Starting MOMO is good for seeing activity that could be start of high gains.

Also while the Double Low Movers is tied to price, Low Float Starting MOMO is not. You can adjust these concepts the way you want, it just works for my needs.

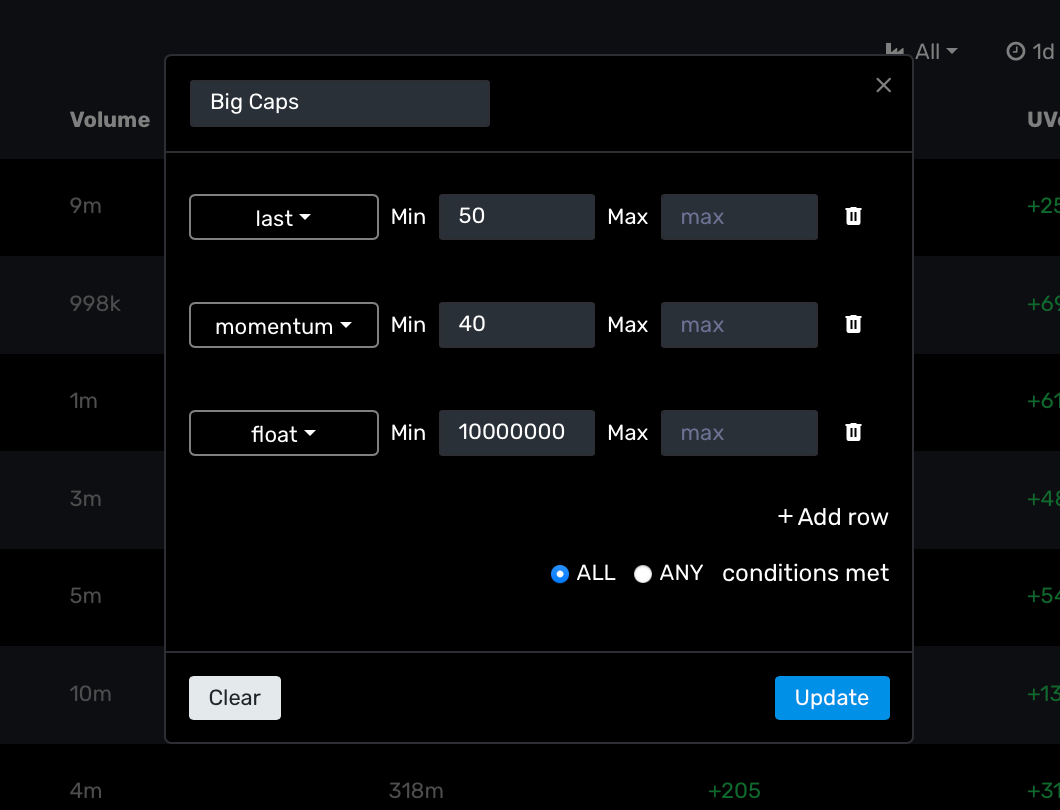

Big Caps: Last on the list is my Big Caps screen. This is more of a swing trade setup and focuses on the continued daily momentum. Why? It showing those with a consistent momentum value through the day and for a big cap, that requires large buying or solid news that should carry through. So these are the stocks that are trading over $50 a share with a momentum > 40. While not technically “Big Caps” they are at least $5B market cap.

The Big Caps screen can help you find the biggest snowball movers (those continuiing to grind higher or lower through the day). Even if you don't trade these tickers, it tells you where the masses are. It can help you spot a theme or hot sector and is good for swing trading the NVDA’s, AMDs and ISRG sized stocks that tend to run for several days in a row.

As you can see scans don’t have to be super complicated. And as I mentioned, don’t forget you can really change the dynamic on these screens by changing the timeframe or industry as well as by sorting (high to low, low to high) by tapping the Discovery column headings. You will certainly see more than enough opportunity on any given day with these scans.

Don't have MOMO yet? Get it here >> Mometic.com

//Profit from Momentum