Something Wicked This Way Comes (GLD/SLV)

The explosive move in Gold and Silver has been the market's most ignored reality. For years, the consensus was to hold this sideways asset as a boredom trade, only to see it recently move with the velocity of a high-flying tech stock. This current behavior is very abnormal.

Gold’s historical utility is its stability—measured oscillations that act as a counter to US Treasuries and a gauge of global health. By trading with this level of unchecked moves, Gold is breaking its correlation with the bond market. It is no longer buoying the financial system, it is breaking out and in my opinion, a concern.

We are ripping up too hard and too quickly – in a very abnormal way.

What's your portfolio's performance year-to-date? Chances are its up double digit gains. Take a look if you haven't. Isn't it ridiculous? It brings up the common quote - "Everyone is a genius in a bull market".

I want to share my thoughts with you...Gold is at $5526/oz and GLD is $507/sh. We're either going to correct really hard or this is intentional and we're on the path to gold revaluation. Trump and Bessent are huge proponents of gold. Even key players of crypto are now huge supporters of gold. Tether is buying $1 billion of physical gold each month and have stockpiled over 140 tons with no plans to stop. Yes, Tether needs to back their USDT stable coin with 1:1 Treasury Bills, but they take their profits and buy gold (which says a lot about where their confidence is).

If there's a sizable drop, then recall that for the entirety of 2025, the dips were bought aggressively and they were short-lived. The most recent correction in 2026 lasted for a few hours. If this same pattern repeats, I think it's dangerous to put a stop loss on gold positions (meaning you get stopped out on a momentary dip and miss the recovery and possible gains). You could potentially put some buy orders to catch value, but its complicated either way.

If there's a revaluation as rumored, then we're going a LOT higher. Some are expecting $8,000 to $10,000 by 2027, but if revaluation is on going to occur, then I've heard prices as high as $20 to $30,000 per ounce! Revaluation would provide Trump and the Treasury trillions of dollars with no additional debt. I have no idea when a possible revaluation could occur. However, if forced to take a guess, the 250th anniversary of the USA would be the perfect event especially since Trump has a liking for theatrics. Of course this is just a wild guess.

What is "Revaluation"?

I had to do some research to clarify myself. Here is what I got for how it works. It's a repricing of gold to current value vs. historic unrealized value and was last done in the 1930's by Roosevelt. In other words cooking the books such that the current price of the gold in reserves which is priced at $43/oz. to a much higher number to offset the debt.

To have a "meaningful impact" (i.e., to restore solvency to the U.S. dollar without requiring a deflationary collapse), the price of gold must be revalued to match the amount of paper money currently in circulation.

Here is the breakdown of where that number comes from and the accounting behind it.

The Revaluation Price Formula

The $20k–$30k gold targets are derived by dividing a specific monetary supply (like M1 or M2 money supply) by the official U.S. gold reserves.

- The Denominator: The U.S. Treasury holds approx 261 million ounces of gold.

- The Numerator: The Money Supply (M1, M2, or Monetary Base).

The Calculation (Jim Rickards' Model)

Under the Federal Reserve Act of 1913 , the U.S. was required to hold gold backing of 40% against the money supply. Using this rule, we can estimate where gold would need to be priced.

- Current M2 Money Supply: ~$21.2 Trillion (approx).

- Target Backing: 40% (Historical Standard).

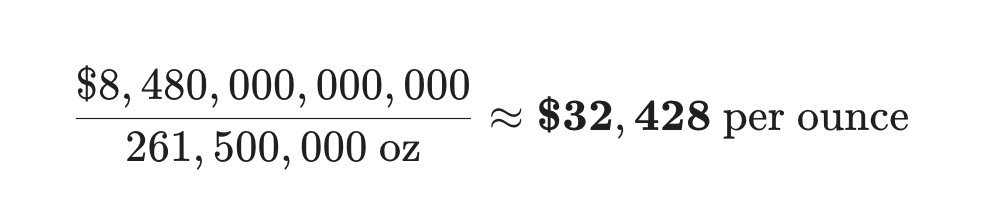

- Required Gold Value: $8.48 Trillion.

The Math:

What else could it be?

It's also no secret that there has been a strong "Sell America" theme being talked about. When the United States and Europe kept Russia's roughly $200B it highlighted the possibility of what could happen to their funds if they didn't play nicely with the USA. Keeping a vault of gold instead of treasuries all the sudden seems to make more sense, particularly if a war is brewing. But the numbers suggest otherwise.

Despite the "de-dollarization" narrative you often hear, the total volume of foreign-owned U.S. Treasuries has not just increased—it has hit all-time record highs.s of the latest data (November 2025), total foreign holdings reached approximately $9.36 trillion, up from roughly $8.7 trillion a year prior.

USD weakening is also another factor. But its movement suggests its at a near term bottom and may also suggest Gold may pause or retreat soon unless there is something bigger at play.

Bringing it back to the first point: The market might be doing the revaluation organically. If the market believes the U.S. eventually has to reprice gold to solidify its balance sheet (to $20k or so), traders will chase gold to get ahead of the official announcement.

I'm definitely far from an expert here, but the move in Gold is undeniable and requires real funds put to work to make this move. While I didn't talk about silver, it has similar affinity coupled with the utility of being heavily used in today's industry. Since it tracks on the gold/silver ratio (GSR) and they both are having moves in kind, it seems fair to consider them together in this context.

Ultimately, in my opinion, owning assets and not having idle cash seems to be reasonable for your investment accounts. Everyone should certainly do their own due diligence, but something unprecedented seems to be underway.

I've diversified significantly in search of protection and while I've enjoyed the moves in Gold and Silver, I've even moved some into PDBC (Invesco Optimum Yield Diversified Commodity Strategy) as well as VTIP (Vanguard Inflation Protected Securities ETF) to try and just put cash to work or prevent erosion.

It's been something else watching all the gold and silver related funds and miners cross MOMO Pro over the past 8 months. It's one of the strengths of the platform as it hits you in the face with the prints day in and out until you take note, even someone as stubborn as myself was able to jump in early and that is saying a lot.

I welcome you to give MOMO Pro a try - we have a 5 day free trial for registered users. Get started here.