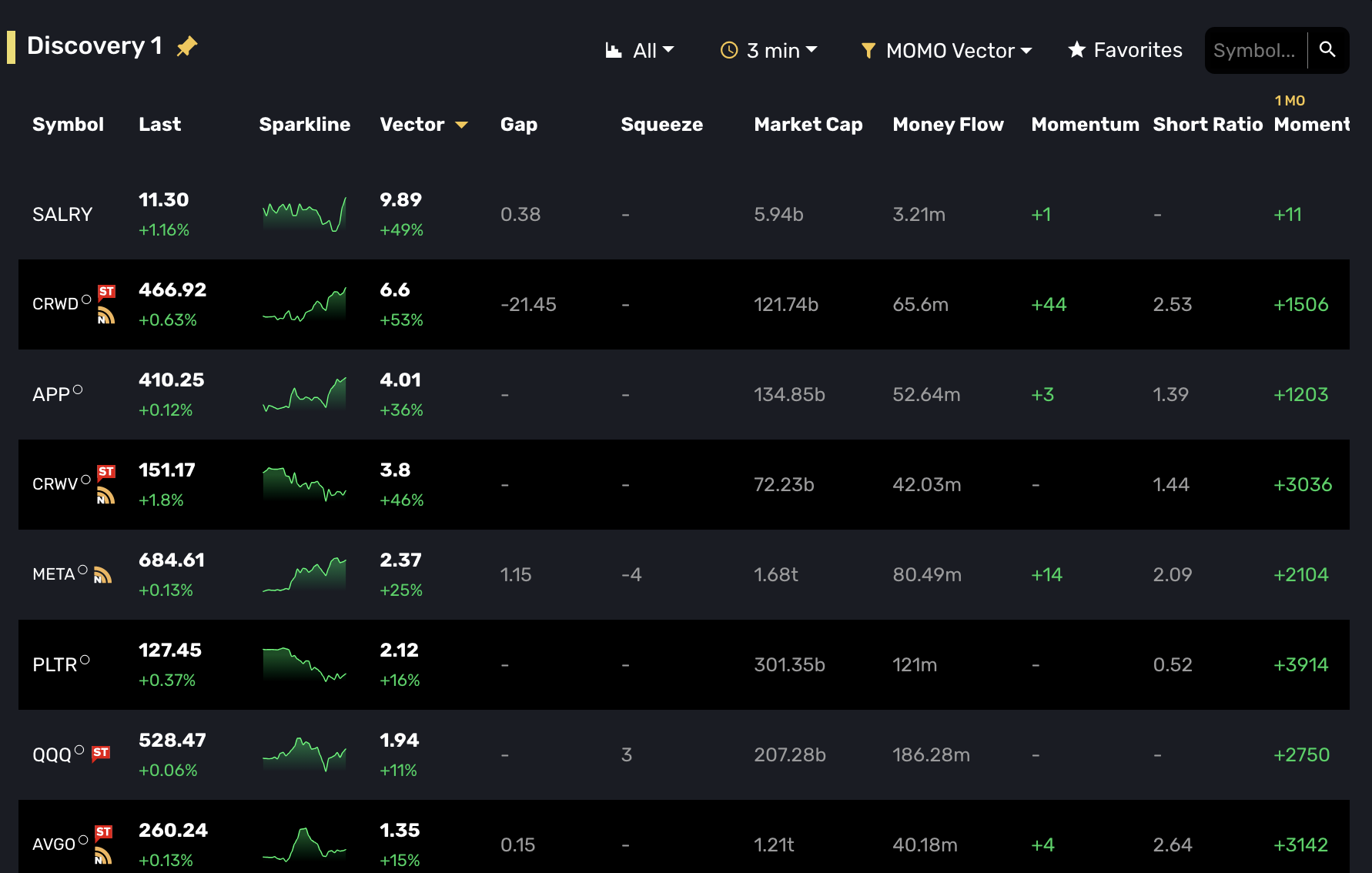

New 3min Discovery Timeframe Now Available

You may be saying... an entire blog post just to announce the addition of a new timeframe? Well, yes! Here is why. First off, we have been building a lot of features that MOMO traders have been requesting and I wanted to get something in that I've been wanting for myself - and a bit surprised it was never requested.

The 3-minute timeframe provides a balanced view for most of our Discovery indicators when compared to 1-minute and 5-minute timeframes. On top of that, it is the timeframe I commonly use on charts when day trading. Technically, there are also a few good reasons to add it.

3 min Timeframe Rationale:

- Noise Reduction: The 3 minute timeframe filters out the erratic fluctuations seen in 1-minute charts, making indicators like UVol, ATR, Trend, Vector, Money Flow, Momentum, Squeeze, RelStr, and VWAP Dist% more reliable.

- Responsiveness: It remains responsive enough for day trading, unlike the 5-minute timeframe, which which can lag in capturing early or "spikey" moves.

- Practical Middle Ground: The 3-minute timeframe offers a clearer, actionable view of short-term trends without the noise of 1-minute screens. Volatile moves get slightly smoothed and unusual relative volume gets averaged while still being plenty quick.

- Net-net: 3 min is highly actionable while reducing noise. It will be better for picking up true trader interest vs. occasional disruptive block trades triggered on 1 min.

MOMO Indicators where 3-Minute Shines:

- Unusual Volume (UVol): More reliable than 1-minute, faster than 5-minute.

- Trend, Vector, Momentum, Squeeze, RelStr%: Smoother signals, better for confirming setups.

- Money Flow, Trades and Trades%, Volume: Clearer view of short-term activity.

- ATR, VWAP Dist%: Practical for intraday volatility and mean-reversion strategies.

My Recommendation:

- Use the 3-minute timeframe as a primary setting for under 1hr holds to balance reliability and speed.

- For scalping or very fast trades, use along with or in place of 1-minute. If starting out, try 3 min first or even toggle between 15min or 3min.

- For longer intraday setups, the 5-minute timeframe can complement 3-minute scans to confirm trends.

- For multi-hour day traders and swing traders, consider adding as a Time Stack custom column instead of 5 or 15min timeframes.

The 3-minute timeframe is something which smooths out "our" (MOMO Traders and myself) efforts to screen for validated moves while giving us a competitive edge over "our"competition (other traders) using static watchlists or platforms without this subtle, but powerful tweak.

Don't have MOMO Pro yet? Get it here!