Gap Scanner Now Available in MOMO Pro+

We all know the feeling... we see news late in the evening or over the weekend that suggests a stock is a screaming buy, or perhaps a dump, and want in (or out) regardless of the last quote. This type of FOMO is contagious, and although we all like to believe that we are uniquely brilliant (because our mothers told us so), many others are also contemplating the same stock that you are watching, in addition to many others that you are likely not even aware of.

Welcome to Gap trading! When a Gap occurs, you see opening bids significantly higher or lower than the prior closing price – as traders see this risk as worthwhile because of the upside opportunity, or conversely, as a precautionary risk-off measure to front run the overnight sentiment shift.

The good news is that these pricing disparaties are easily tracked as "Gaps". The popularity of Gaps (aka Gappers) has been hard to ignore as people are looking to play this action more than ever in our less than bullish environment. Communities have even sprung up dedicated to trading Gaps, and today, we are happy to introduce our Gap scan capability to let you more easily uncover these moves.

Personally, I have not been one to go out of my way to scan for gaps – that is until we began testing our scan. Not only do I see the "scalp-ability", but the buzz and action around gaps is definitely evident. My excuse for staying away from Gaps? I don't really have one other than MOMO presents plenty of opportunity day in and out and maybe have been a bit stubborn to not investigate further.

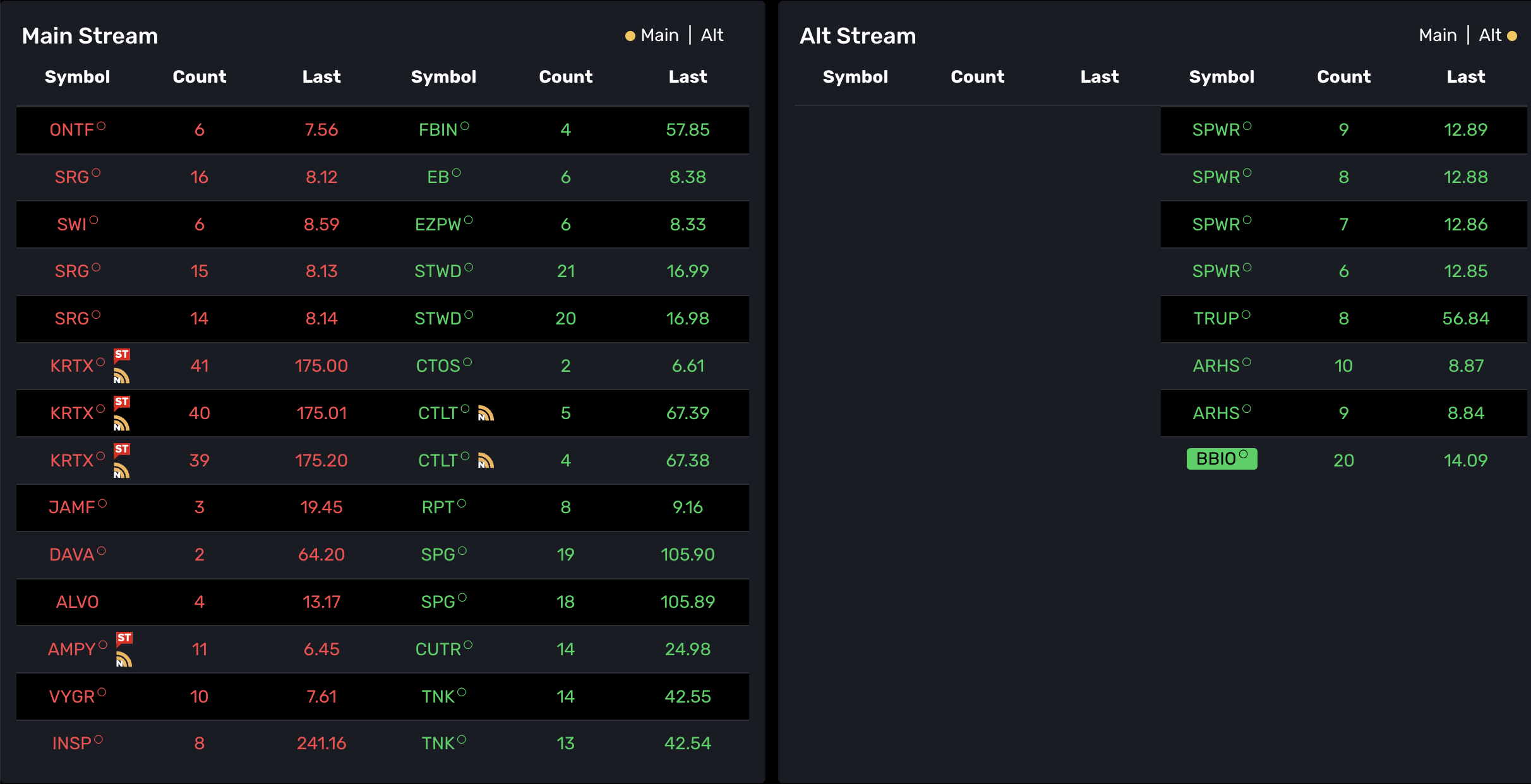

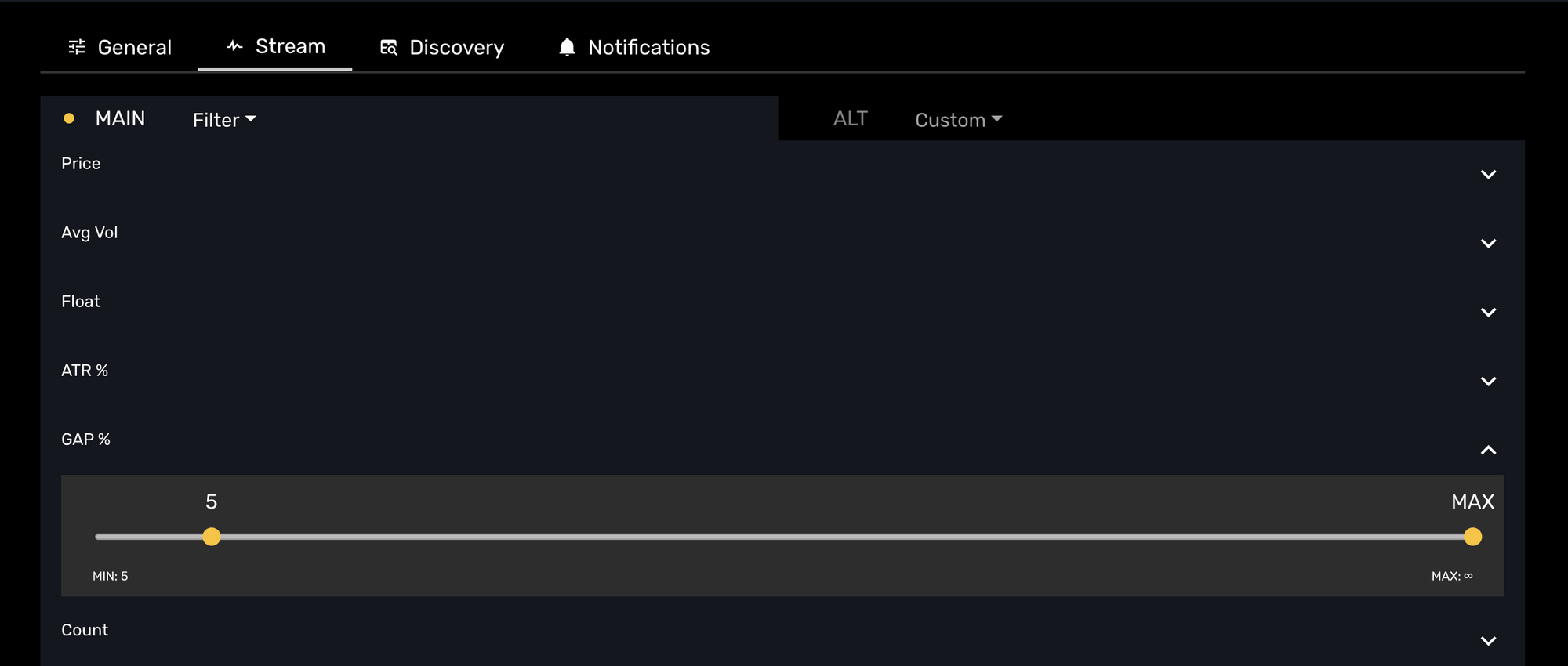

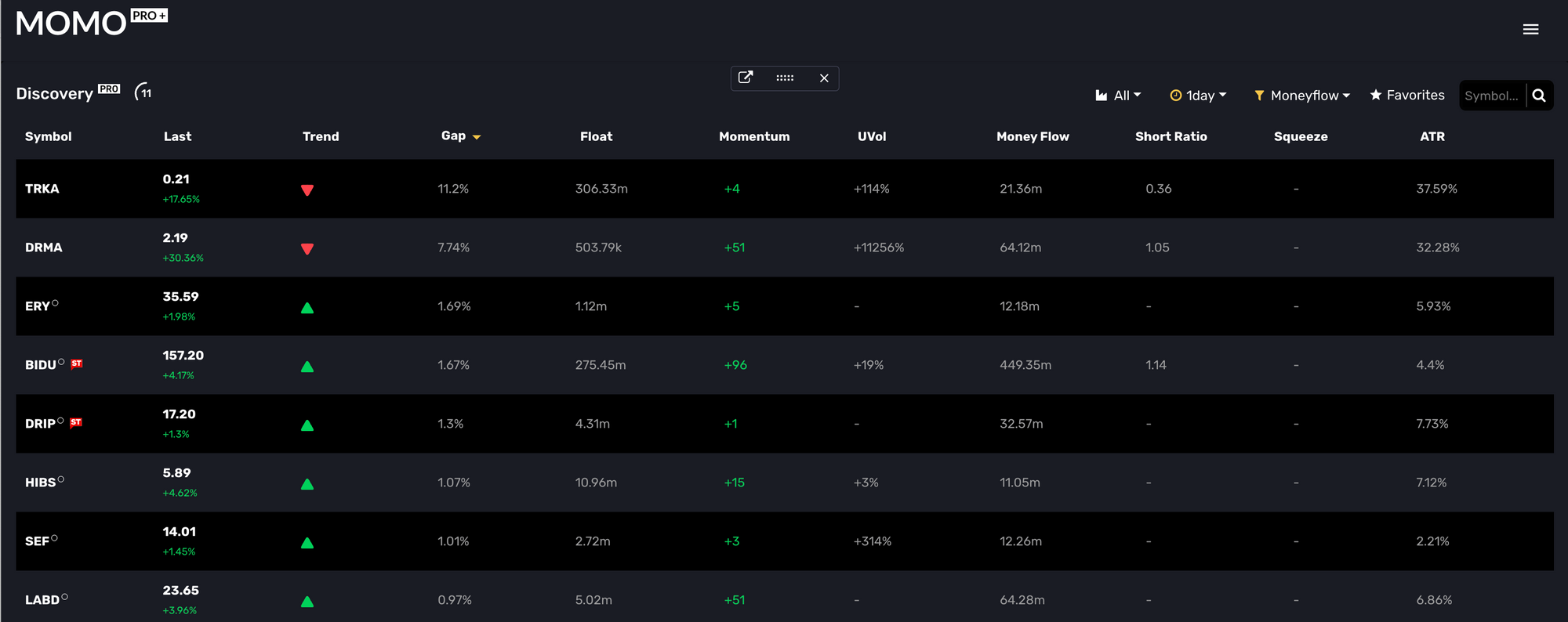

Our new Gap capability has been incorporated into our Stream scan and our Discovery screen as well as our Conditional notifications so you can easily incorporate your Gap scan strategy across the entire MOMO platform (Pro+ plan only).

Worth stating Gaps (similar to ATR) are showing stocks with high volatility but are not necessarily "easy profits". Experienced trading eyes see these as well and the liquidity is eagerly played by institutions and fellow contrarian traders. Keep in mind, Gaps are only based on the Daily timeframe in Discovery and are not going to vary across Discovery timeframes (same as short interest ratio, float, and others).

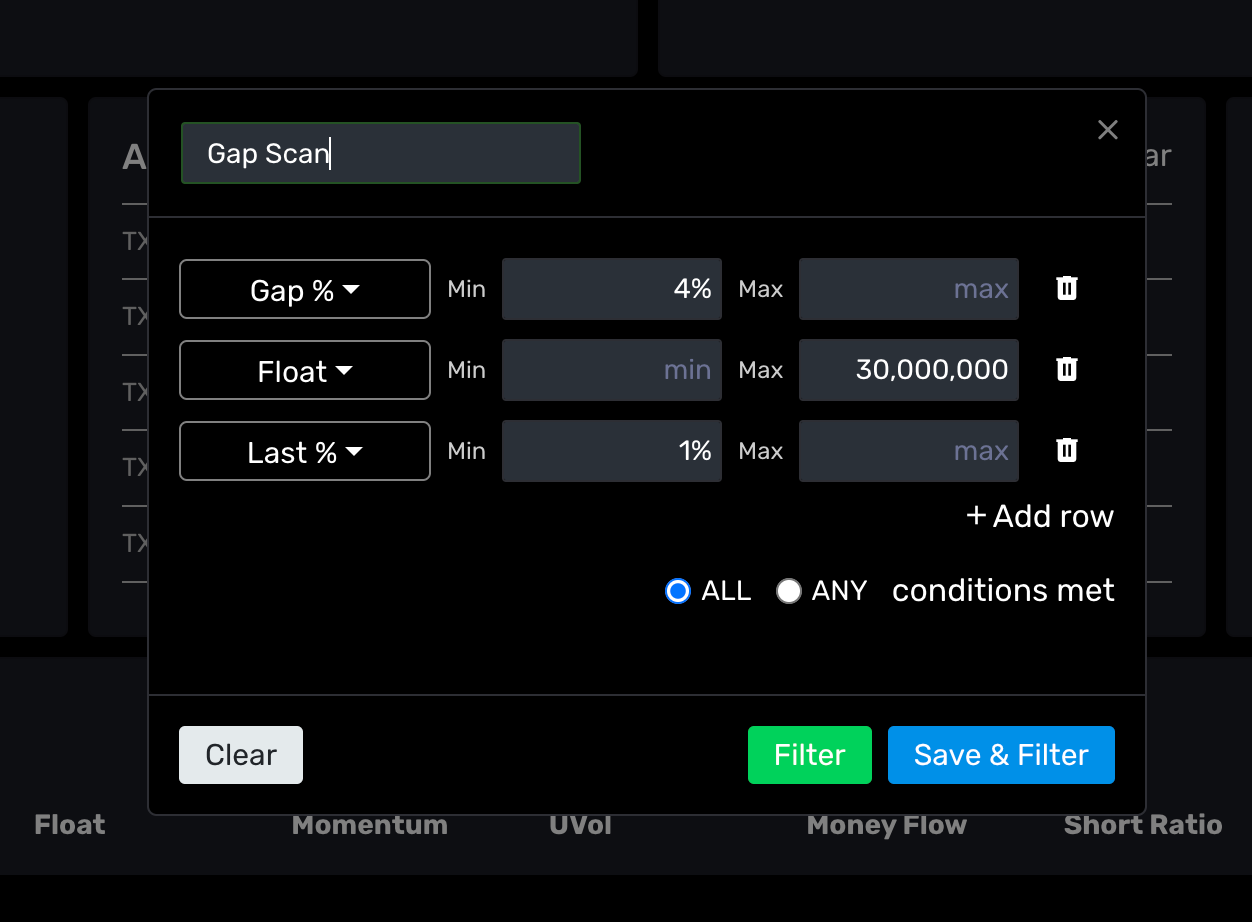

And as you may have thought, you may build multi-criteria filters using Gap% along with existing MOMO Pro+ algorithms and parameters such as price range, sector, float, volume or MOMO Trend.

About our Gap Scan implementation:

There are several ways to define a "gap", but we took the most straight forward interpretation. Our gaps are measured based on prior day close. The best way to scan in the morning for the gap is via Discovery view and sort based on gap column. In settings, you may choose to display the dollar change or percentage change (although we have limited the filter and condition criteria to only a percentage-based selector for simplicity).

Lastly, we reflect gap fills based on pricing pressure closing the gap. What this means is if something opens with a 5% gap that gap could be reduced or eliminated through the course of the day based on the price action.

The Gap scan is only available as part of MOMO Pro+, so if you are a MOMO Pro or MOMO basic subscriber you will need to upgrade.

Don't have MOMO Pro+ yet? Start here!

Team @ Mometic