Now Available - Relative Strength Screen!

As the saying goes - a high tide raises all boats and the same usually goes with the markets to the extent it becomes difficult to screen for anomolous and outsized activity. To solve that we have released a our Relative Strength screen.

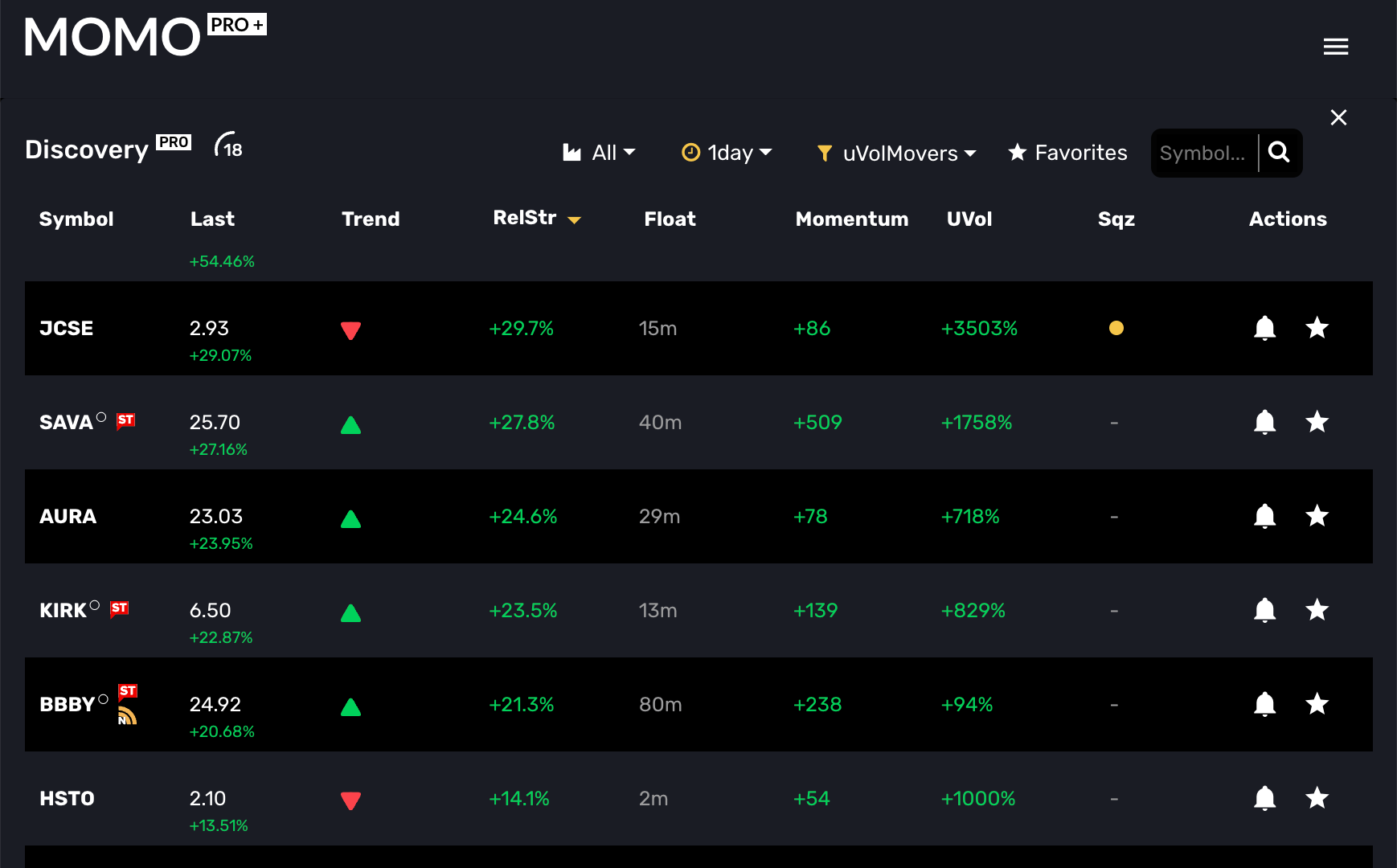

As of today all MOMO Pro and Pro+ subscribers will now have "RelStr" as an available column to show relative strength vs. SPY. Keep reading if you want the details.

MOMO's Relative Strength Explained

When the indices rise, most other stocks do as well whether due to FOMO, ETF & portforlio balancing, or other automated methods. As such, if the market is going up 1% and other stocks are doing the same you are not really making meaningful decisions, nor "beating" the market.

However, if you can evaluate gains and losses relative to overall market you can hone in on stocks showing differentiated strength (or weakness). The calculation is simply a timeframe-based difference of a given stock's gains vs the SPY.

As you can see there is decent degree of correlation between RelStr and other fields, but it does give another way to scrub the data. It also is timeframe sensitive enabling you to evaluate relative strength from minutes to months. Additionally, you can build custom filters and build conditional alerts using RelStr.

Lastly - since we are starting to add more columns its worth re-sharing that you can rearrange, disable and prioritize columns to fit your needs and device type within Discovery settings.

What may not be apparent is those items dragged to the top of the priority will be kept visible even across smaller screen sizes. Those columns at the bottom of the list will be hidden first as you adjust or switch device types.

That is all on our relative strength. If you have any questions, please reach out. If looking to try MOMO Pro, get started here.

Team @ Mometic